Garrett Motion Inc (GTX) has announced that it has filed for bankruptcy by commencing voluntary Chapter 11 cases with the United States Bankruptcy Court for the Southern District of New York.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

At the same time, GTX entered into a definitive agreement with private-equity firm KPS Capital Partners, LP to serve as stalking horse bidder to purchase the business for $2.1 billion.

The KPS stalking horse transaction agreement is subject to higher or better offers in the bankruptcy case. Closing of the transaction is subject to customary regulatory approvals, as well as court approval and other customary conditions.

Olivier Rabiller, CEO of Garrett, said, “Although the fundamentals of our business are strong and we have continued to try to develop our business strategy, the financial strains of the heavy debt load and liabilities we inherited in the spin-off from Honeywell – all exacerbated by COVID-19 – have created a significant long-term burden on our business.”

“This proposed transaction will provide a capital structure and institutional support to ensure our long-term viability and set the foundation for the next phase of Garrett’s growth,” Rabiller said.

In connection with its reorganization, GTX entered into a Restructuring Support Agreement with holders of approximately 61% of its outstanding senior secured debt and said that it is seeking court approval of $250 million of debtor-in-possession financing, arranged by Citigroup.

According to GTC, the proceeds of the new financing, which is subject to court approval and other conditions, will supplement cash flow from ongoing operations and bolster the company’s liquidity position during the Chapter 11 cases.

Throughout the process, Garrett says that it expects to operate without interruption. It anticipates emerging from the Chapter 11 and completing the sale process in early 2021. Upon the closing of the transaction, Garrett will operate as a private company.

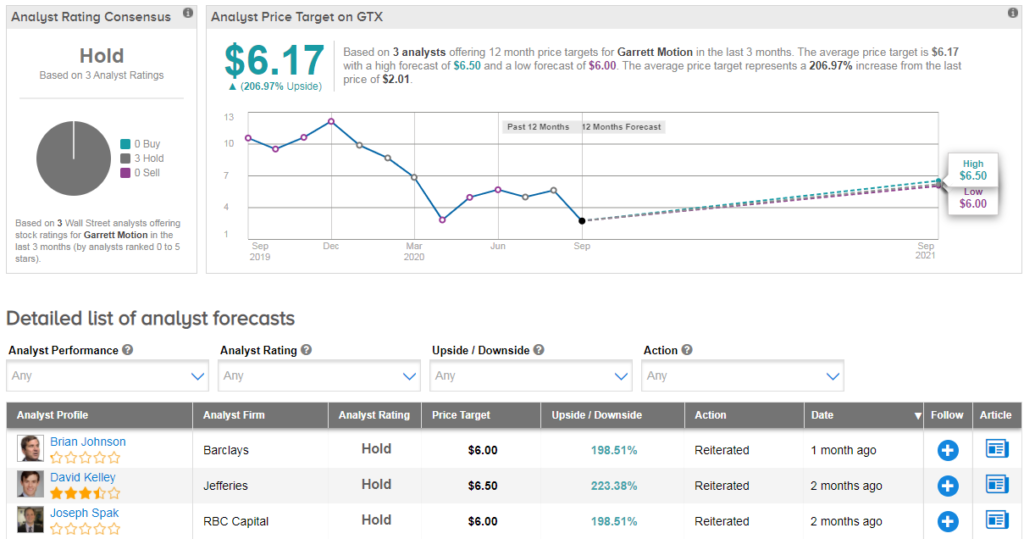

Three analysts have published hold ratings on the stock recently, giving Garrett a Hold analyst consensus. Meanwhile shares have plunged 80% year-to-date.

“While GTX operations have held up OK and the company has shown it can be cash flow generative, there are significant calls on that cash (including to Honeywell) so the capital structure limits its flexibility and could put it at a competitive disadvantage” commented RBC Capital’s Joseph Spak on August 26.

“GTX is fighting HON and payments in dispute have been deferred until 2Q23, but GTX will face harsh catch-up payments in 2023-2024, creating ~$410mm and $365mm in payments respectively” he explained. (See GTX stock analysis on TipRanks).

Related News:

Rolls-Royce Seeks To Raise $2.5B, Including From Singapore’s GIC- Report

Nikola Sinks 23% As Founder Milton Steps Down Amid Short-Seller Fraud Debacle

Oasis Petroleum Drops 8% After Deferring Interest Payments