Apparel retailer Gap (NYSE:GPS) delivered mixed results for the second quarter of 2023. While earnings exceeded estimates by a wide margin, revenue fell slightly short. The company’s performance was impacted by weakness across all four of its brands as consumers continued to hold back on discretionary spending. Regarding its projected outlook, GPS updated its guidance for the fiscal third quarter and Fiscal Year 2023 with expectations of a “continued uncertain consumer and macro environment.”

GPS reported unexpected adjusted earnings per share (EPS) of $0.34, while Wall Street estimates were pegged at $0.09. Moreover, the bottom line increased 325% year-over-year from $0.08 per share in the prior-year quarter.

Meanwhile, revenue fell 8% year-over-year to $3.55 billion, missing the consensus estimate of $3.58 billion. In the reported quarter, comparable and store sales were down 6% and 7%, respectively, year-over-year, with online sales decreasing by 11%.

The major year-over-year decline was witnessed in Gap stores, down 14% to $755 million. Also, revenue from Banana Republic fell 11% to $480 million. Finally, sales from Old Navy and Athleta declined by 6% and 1%, respectively.

Moving on, Gap’s Q2 adjusted operating margin expanded over 170 basis points (bps), with adjusted gross margin registering a 160-bps increase. This is primarily due to lower air freight expenses and improved promotional activity, partially offset by inflationary headwinds.

It is worth highlighting that Gap’s new CEO Richard Dickson took over his responsibilities just two days prior to the earnings release. Importantly, Dickson is known for his exceptional role in turning around Mattel’s (MAT) Barbie franchise.

Outlook

The company expects third-quarter net sales to decline in the low-double-digit range from last year’s quarter sales of $4.04 billion. The decrease is primarily due to the sale of Gap China to Baozun, which closed on January 31, 2023.

Additionally, Gap anticipates that Fiscal 2023 net sales could decrease in the mid-single-digit range compared to net sales of $15.6 billion in Fiscal 2022. This compares to a low to mid-single-digit decline previously projected by the company.

Is GPS a Good Stock to Buy?

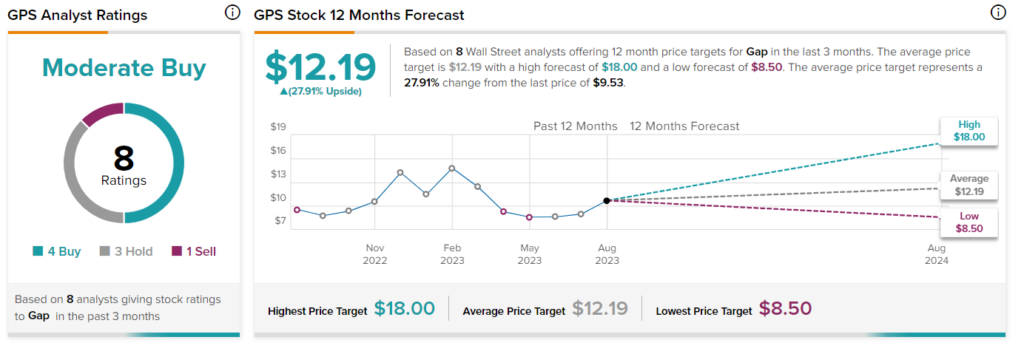

Following the results, Guggenheim analyst Robert Drbul is projecting improvement in margins and EPS growth in the near to medium term. Also, he believes the risk-reward ratio of GPS is attractive at current levels. Drbul maintained a Buy rating and a price target of $18 on GPS stock.

On TipRanks, GPS stock has an average price target of $12.19, which implies 27.91% upside potential from the current level. Also, based on four Buy, three Hold, and one Sell ratings assigned in the past three months, Gap has a Moderate Buy consensus rating. The stock is down about 13% so far this year.