GameStop Corp. announced an early redemption of its senior notes due in 2021. The world’s largest video game retailer said “it will redeem $125 million in principal amount of its 6.75% Senior Notes due 2021 on December 11, 2020.”

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

GameStop’s (GME) voluntary redemption represents about 63% of its outstanding notes at a price of 100% of their principal amount coupled with accrued and unpaid interests. GameStop’s CFO, Jim Bell, said “the voluntary early redemption of $125 million in senior notes is consistent with our strategy to take actions that strengthen and enhance our balance sheet, improve our debt profile and optimize our capital structure.”

Earlier, on Nov. 9, GameStop unveiled its 2020 holiday deals and announced expanded store hours for the Black Friday weekend. The company said the “Black Friday Countdown” sale event will start from Nov. 14 and run till Nov. 21. The company will offer deep discounts on video games and PC gaming bundles.

GameStop’s chief merchandising officer, Chris Homeister said “We’re pulling out all the stops this holiday to reward shoppers with deep discounts – both before and on Black Friday,” (See GME stock analysis on TipRanks).

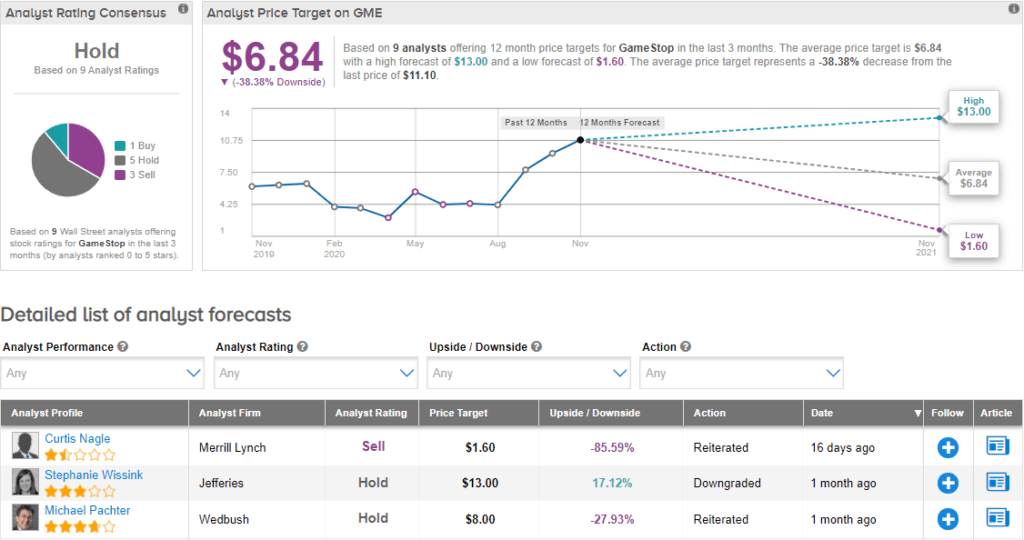

On Oct. 9, Wedbush analyst Michael Pachter reiterated his Hold rating on the stock with a price target of $8 (27.9% downside potential). Pachter said “We expect shares to trade at a compressed EPS multiple until next generation consoles launch and GameStop can demonstrate a path to consistent profitability.”

Currently, the Street has a Hold consensus on the stock, with 5 holds, 1 buy, and 3 sells. The average price target stands at $6.84, implying downside potential of about 38.4% to current levels. Shares are up about 82.6% year-to-date.

Related News:

Sprout Social’s 2020 Outlook Surprises; Stock Up 173% YTD

Cars.com Surpasses 3Q Estimates On Improved Online Traffic

BTIG Flips To Buy On Square; Stock Up 194% YTD