GameStop (GME) is surging 8% in Wednesday’s pre-market trading after Senvest Management disclosed ownership of 3.6 million shares in the video game retailer. That equates to a 5.54% stake.

The New-York based fund, which was founded by Richard Mashaal in 1997, employs a contrarian, value-based investment strategy across more than $1 billion in assets under management.

“We seek out of favour, unloved, misunderstood, and underappreciated companies where expectations, sentiment and valuations are all low. Over one or two or three years they can change and improve, for a better outlook, so they are no longer unloved, and get multiple expansion,” Mashaal told The Hedge Fund Journal back in 2017.

Earlier this week the company announced plans to roll-out deep holiday savings with the launch of its first-ever ‘1Up’ 48-Hour sale, beginning on October 13. According to the company the event involves over 100 deals on its website and mobile app.

GameStop will continue by launching its PRO Days sale and expanding it to four days, with exclusive deals on video game hardware, software, accessories, and pop culture merchandise.

“This year, we are pulling out all stops to reward our loyal customers with early holiday deals across all gaming and collectibles merchandise,” cheered Chris Homeister, chief merchandising officer for GameStop.

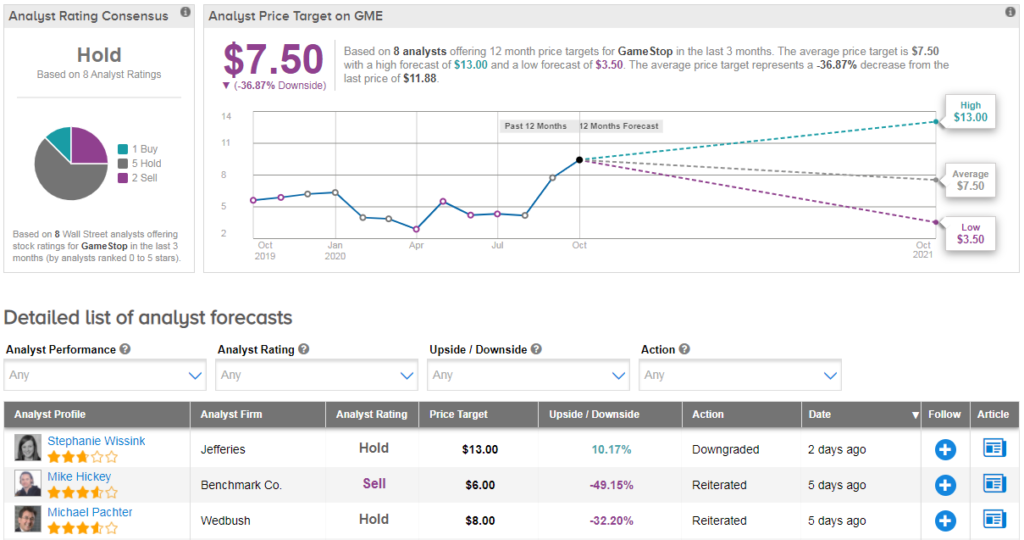

Shares in GME have almost doubled year-to-date, boosted by a recent tie up with Microsoft. However as a result of the rally, Jefferies analyst Stephanie Wissink has now downgraded GameStop from buy to hold.

“Early cycle drivers are known – console unit sales will outstrip supply, software attach rates will be robust, subscription revshare adds bonus value, and bal. sheet is healthy. Looking out, we can map new value drivers (in concept) to fully counter reduced packaged SW sales but still too early to fully underwrite in valuation,” writes Wissink.

“We are setting our PT at $13 – high end of our prev. upside range. The combination of net cash ($6/sh), near-term HW demand (2+ months of wait lists), high SW attach, & subscription rev-share justify the EV at $13/sh.” Her new price target indicates 9% upside potential from current levels. (See GME stock analysis on TipRanks)

Her take on GME is echoed by the rest of the Street, which shows a cautious Hold consensus. The average analyst price target stands at $7.50, indicating significant downside from current levels.

Related News:

Apple Launches First iPhone With 5G; Shares Drop

Disney Plans Major Shake-Up To Focus On Streaming Business

GameStop Explodes 44% On Major Microsoft Tie-Up, As Trading Resumed