Video game retailer GameStop Corp. (NYSE: GME) recently revealed that it has let go of its Chief Financial Officer, Mike Recupero, in a managerial reshuffle. Meanwhile, the company is also planning to cut jobs to curtail its costs.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Shares of the company rose 15.1% in the normal trading hours on Thursday but declined about 7% to close at $128.25 in the extended trading session.

Managerial Changes

In a report, The Wall Street Journal stated that Recupero “is leaving after roughly a year in the role.” Chief Accounting Officer and Former Interim CFO Diana Saadeh-Jajeh will now become the CFO.

Meanwhile, in a filing, the company revealed that Saadeh-Jajeh is set to pocket an annual base salary of $200,000 in her new role. She will also be eligible for a bonus of roughly $1.97 million, which is to be paid biweekly over a two-year period.

Cost Cutting Measures

In an internal memo, the company cited that it was reducing its workforce to “keep things simple and operate nimbly.”

In the memo, the company added, “This means eliminating excess costs and operating with an intense owner’s mentality. Everyone in the organization must become even more hands-on and embrace a heightened level of accountability for results.”

GameStop has not been able to turn a profit in recent years as consumer preferences have changed. In its latest results for the first quarter, the company reported a net loss of $157.9 million, wider than the previous year’s loss of $66.8 million. The top line, however, witnessed a year-over-year rise of 7.8% to $1.38 billion.

Interestingly, the reshuffle comes after the company’s Board approved a four-for-one stock split of its Class A common stock. The company expects the move to provide support to its stock price and attract investors.

Muted Prospects

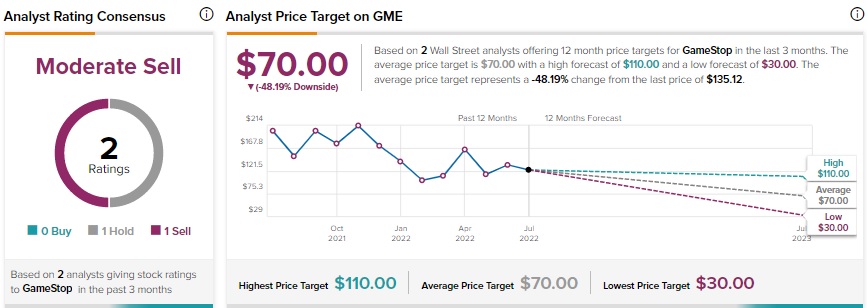

On TipRanks, the stock has a Moderate Sell consensus rating based on one Hold and one Sell. GME’s average price target of $70 implies downside potential of 48.2% from current levels. Shares have declined 29.4% over the past year.

Website Traffic Projects a Gloomy Picture

According to TipRanks, the GameStop website recorded a 17.48% monthly fall in global visits in June, compared to the same period last year. Further, the footfall on the company’s website has declined 24.19% year-to-date, compared to the previous year.

GameStop’s declining website traffic trend raises concerns that the company may continue to incur losses in the upcoming quarter.

Key Takeaway

The appointment of an internal hand like Diana Saadeh-Jajeh will ensure a smooth transition. Further, mere job cuts are not expected to limit the losses of the company, and it should consider strategic reforms to become profitable.

Read full Disclosure