Gambling.com (GAMB), a marketing company that facilitates connections between online gambling operators and players, is on a winning streak and recently reported impressive Q2 2024 results, beating top-and-bottom-line expectations. Notably, the company’s sports segment has experienced considerable growth, positioning it to benefit from the explosive growth of sports betting and online gambling and the rising number of younger bettors gravitating to online gambling.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The stock has been up over 23% in the past 90 days, yet it trades at a discount to industry peers, suggesting room for further price appreciation. Investors interested in exposure to the gambling industry might find this a compelling option.

Gambling.com’s Growing Footprint

Gambling.com is a digital marketing company catering to the online gambling industry. It offers marketing services designed for iGaming and social casino products, though GAMB’s focus is on online casinos, sports betting, and the fantasy sports sector.

The company has steadily grown, adding over 108,000 new depositing customers (NDC) in the most recent quarter. It successfully acquired Freebets.com, which joins other branded websites it owns and operates, such as Gambling.com, Casinos.com, RotoWire.com, and Bookies.com.

The U.S. sports betting industry, valued at $10 billion, is expected to grow significantly. With approximately half of the states having already legalized mobile sports betting, ongoing developments in the industry suggest market growth driven by additional states legalizing sports betting and increased consumer spending could see spending on sports betting climb to $45 billion annually.

Gambling.com’s Recent Financial Results

The company recently shared its financial results for the second quarter of 2024. Revenue rose 18% year-over-year to $30.54 million, beating analysts’ estimates of $26.98 million while marking a quarterly record. Adjusted EBITDA increased 19% year-over-year to $11.2 million, and gross profit saw an uptick of 16%, resulting in $29.1 million. Total operating expenses declined 15% to $20.8 million, helping gross margins increase to 95%. GAMB reported earnings per share of $0.20, surpassing analysts’ estimates of $0.13.

Following second-quarter results, GAMB’s management has revised guidance upward for 2024, anticipating revenue of $123 million to $127 million and Adjusted EBITDA of $44 million to $47 million. This is a marked increase from the previous estimates of $118 million to $122 million in revenue and Adjusted EBITDA of $40 million to $44 million. The company projects a full-year cost of sales of approximately $6.5 million, of which $3.7 million was spent during the first half of 2024.

What Is the Price Target for GAMB Stock?

The stock has been on an upward trend, climbing 58% in the past three years. It trades near the middle of its 52-week price range of $7.52 – $14.63 while demonstrating positive price momentum by trading above its 20-day (9.26) and 50-day (8.88) moving averages. With a P/E ratio of 15.2x, the stock trades at a relative discount to the Gambling industry average of 17.5x.

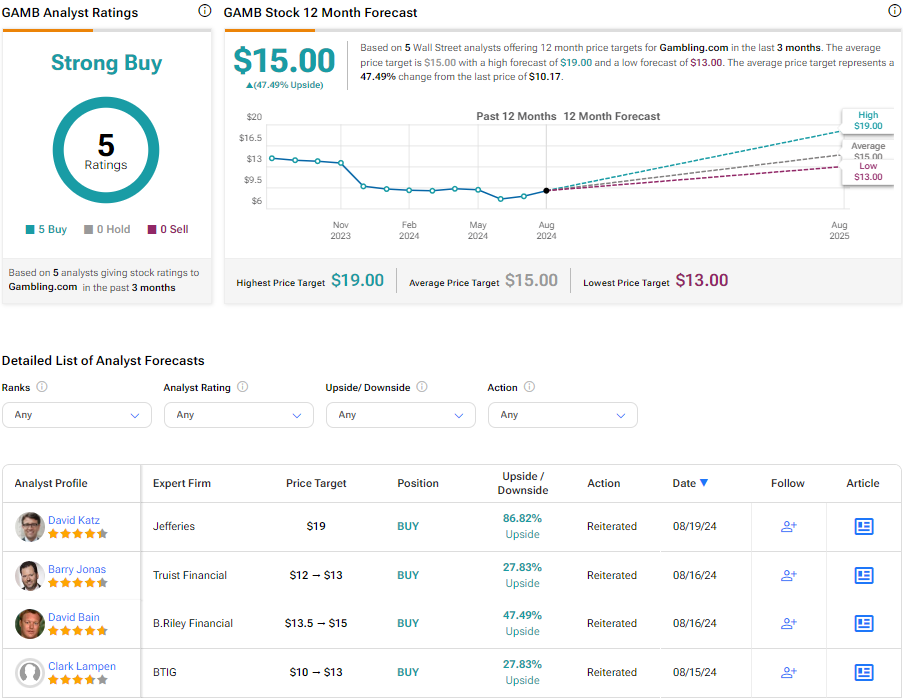

Analysts following the company have been bullish on the stock. For example, Truist analyst Barry Jonas recently raised the price target from $12 to $13 while keeping a Buy rating on the shares, noting the company’s Q2 beat driven by NDC growth.

Based on the aggregate recommendations and price targets assigned by five analysts, Gambling.com is rated a Strong Buy. The average price target for GAMB stock is $15.00, representing a potential upside of 47.49% from current levels.

GAMB in Summary

Gambling.com is well-positioned to participate in the online gambling industry’s remarkable growth. Its ongoing growth through the addition of online assets and steady new customer acquisition makes it an enticing proposition even as it trades at a discount to industry peers. Investors interested in participating in the gambling industry’s upside may find GAMB compelling.