Futu Holdings Limited (FUTU), a tech-driven online brokerage and wealth management platform based in Hong Kong, reported robust results for the second quarter of 2021.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Shares of Futu Holdings, with a current market capitalization of $14 billion, have jumped 188% over the past year.

The company reported adjusted earnings of HK$3.47 ($0.45) per ADS, growing 86.6% from HK$1.86 per ADS reported in the prior-year period. (See Futu Holdings stock charts on TipRanks)

Furthermore, revenues surged 129.3% year-over-year to HK$1.6 billion ($203 million). The increase in revenues reflected a surge in brokerage commission and handling charge income, which increased 94.8% to HK$797.7 million ($102.7 million), as well as 193.6% growth in interest income to HK$610.3 million ($78.6 million).

On top of this, gross profit margin jumped 470 bps to 82.3% compared to 77.6% in the second quarter of 2020, driven by higher operating leverage.

Key Milestones Achieved During the Quarter

During the second quarter, Futu’s paying clients grew 230.2% year-over-year to touch the record 1 million mark. Notably, half of the net addition came from Singapore, one of its key growth markets. In addition, the total number of Futu users increased 66.8% year-over-year to 15.5 million.

Furthermore, Futu’s shares were added to the MSCI Hong Kong Index.

Markedly, Futu became the first online broker in the Asia-Pacific region to have obtained an investment grade, long-term issuer credit rating “BBB-” from S&P Global Ratings during the quarter.

Total client assets grew 253.5% year-over-year to HK$503.2 billion, while the client retention rate remained high at 97.8% despite the stock market pullback.

Furthermore, Futu’s wealth management business Money Plus established 7 new partnerships with internationally-renowned asset managers like Goldman Sachs, UBS, and Principal.

Futu CEO Mr. Leaf Hua Li commented, “Going forward, we are committed to defending our leading position in Hong Kong, leveraging word-of-mouth referral and marketing to grab market share in Singapore, and accelerating self-clearing for U.S stock trading to improve profitability and operational flexibility.”

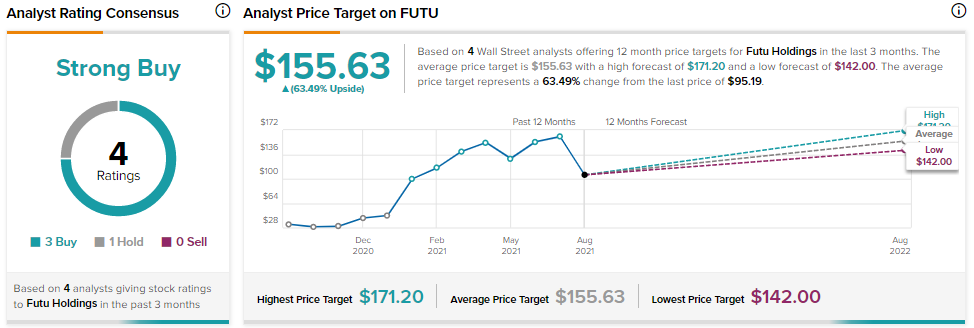

CCB International recently initiated coverage of Futu Holdings with a Buy rating and a price target of $171.20 (79.9% upside potential).

Overall, the stock has a Strong Buy consensus rating based on 3 Buys and 1 Hold. The average Futu Holdings price target of $155.63 implies 63.5% upside potential from current levels.

Related News:

Cloudera Posts Upbeat Q2 Results, Privatization Deal on Track

Yandex Restructures Uber Collaboration in Deal Worth $1B

Ashland Sells Performance Adhesives Business to Arkema for $1.65B