Noted fund manager Terry Smith has expressed skepticism about Nvidia’s (NVDA) future, even as the AI leader continues to surge. NVDA stock has been trending upward recently. Last week, it reached a record market cap of $3.65 trillion. But even as the company benefits from rising bullish sentiment, Smith remains unconvinced that its growth will continue. In a recent interview, he raised questions about the future of AI, highlighting concerns that could impact chipmakers like Nvidia.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What’s Going On with Nvidia Stock Today?

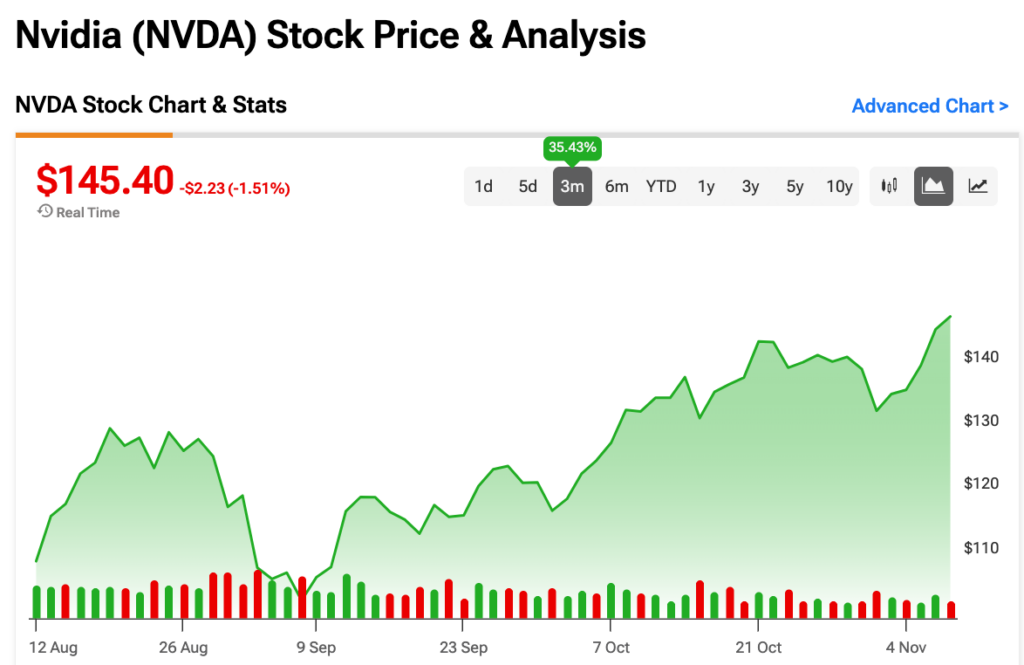

While Nvidia stock is down today, this is likely due to negative market momentum, as the company hasn’t reported any negative catalysts. As of this writing, shares are down 2% after rising slightly in premarket trading. NVDA stock is often subject to volatility, but it can usually shake it off and continue rising. Over the past quarter, it has managed to continue rising in a sometimes difficult market, rising from $102 per share to its current price of $145.

Even with this progress, Smith is concerned about the unpredictable nature of AI, specifically whether future revenue will justify the large-scale investments being made by companies in the space now. As he sees it, if customers are not “willing to pay on a sufficient scale and at a sufficient price,” the demand for products like Nvidia’s chips will likely be compromised.

On top of that, Smith predicts that Nvidia’s prospects could be threatened by rising competition, even if its high margins persist. As Bloomberg reports, these types of concerns led to a massive selloff between June and August 2024, which decreased Nvidia’s value by roughly $900 billion. However, NVDA stock has since rebounded, and its performance has been encouraging.

Wall Street Remains Highly Bullish on Nvidia Stock

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 38 Buys, and three Holds assigned in the past three months, as indicated by the graphic below. After a 196% rally in its share price over the past year, the average NVDA price target of $154.28 per share implies 7% upside potential.

Nvidia is scheduled to report Q3 earnings on November 20, 2024. Analysts, such as Harsh Kumar of Piper Sandler, have expressed optimism that the company will exceed Wall Street revenue estimates, highlighting robust demand for its products. Smith is approaching NVDA stock with caution, but the consensus throughout Wall Street is that Nvidia still has room to grow.