Shares of FuboTV Inc. dropped 4.5% in pre-market trading on March 3 as the sports television streaming platform’s losses widened in the fourth quarter. The company reported a 4Q loss per share of $2.47 that widened from the loss per share of $1.07 incurred during the same quarter last year. Analysts had expected a loss of $0.85 per share.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Meanwhile, FuboTV (FUBO) reported its strongest 4Q sales in its history of $105.1 million that topped consensus estimates of $93.9 million.

FuboTV’s CEO David Gandler said, “fuboTV’s fourth quarter closed our strongest fiscal year to date. Our record 547,880 paid subscribers streamed more sports, news and entertainment content than ever before. Building on this quarter and year, we remain focused on continued innovation and are excited about our growth opportunities for 2021, including the ongoing expansion of our advertising business and the development of our own sportsbook.”

FUBO’s quarterly sales growth was driven by advertising revenue which spiked 157% year-on-year to $13.1 million.

The company earned average revenue per user (ARPU) of $69.19 while advertising ARPU was $8.47. (See FuboTV stock analysis on TipRanks)

In the first quarter of FY21, FUBO expects revenues to generate $101 million to $103 million with a subscriber range of between 520,000 to 530,000. For FY21, the company forecasted revenues of between $460 million to $470 million and projected subscriber numbers to reach between 760,000 to 770,000.

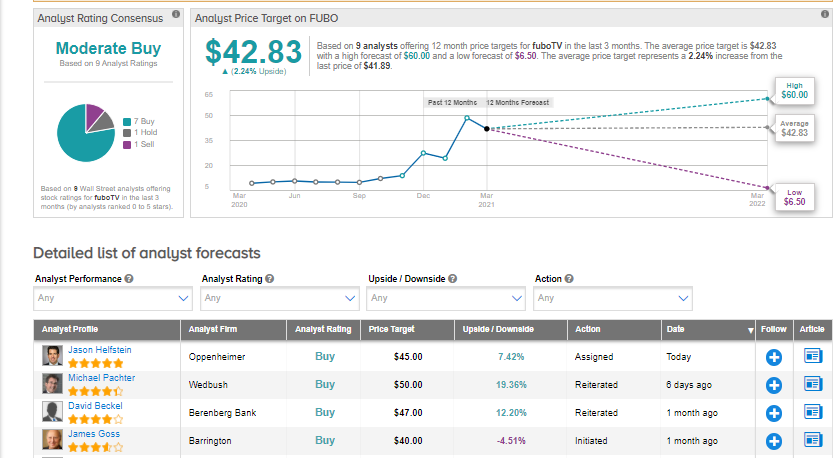

Following the 4Q results, Oppenheimer analyst Jason Helfstein raised the stock’s price target from $30 to $45 and reiterated a Buy rating.

Helfstein wrote in a note to investors, “1Q guidance suggests muted churn relative to 2020. With the completion of Balto Sports & Vigtory acquisitions, company plans to launch free-to-play gaming app in 3Q:21, and go live with FUBO sportsbook in 4Q:21.”

“fuboTV is well positioned to benefit on the industry-wide shift to over-the-top (OTT) streaming services and now, online sports betting. Most OTT providers have focused on low-cost entertainment offerings, forcing sports fans to remain tethered to pay TV. fuboTV is exploiting the opportunity in sports by providing a comparable viewership experience at a lower cost than its pay TV counterparts,” the analyst added.

The rest of the Street is cautiously optimistic on the stock with a Moderate Buy consensus rating based on 7 Buys, 1 Hold and 1 Sell. The average analyst price target of $42.83 implies around 2.2% upside potential to current levels.

Related News:

Urban Outfitters 4Q Sales Fall Due To COVID-19; Shares Slip

Roku Snaps Up Nielsen’s Video Ad Business; Shares Gain 3.7%

Boingo Wireless Pops 25% On $854M Takeover Deal By Digital Colony