Investors looking for a steady income stream can consider investing in dividend stocks. These stocks also have the potential to generate notable capital gains. Thus, using the TipRanks Stock Screener tool, we have shortlisted two stocks – Frontline (NYSE:FRO) and Kimbell Royalty Partners (NYSE:KRP). These stocks offer a dividend yield of more than 10%, and their 12-month price targets reflect a solid upside potential of more than 15%.

Let’s take a closer look at both stocks.

Is Frontline Stock a Buy?

Frontline is an international shipping company that owns and operates oil and product tankers. The favorable supply-demand environment will likely drive shipping rates for products and oil tankers. Moreover, the persistent geopolitical tensions in the Middle East are expected to support FRO’s performance in the near term. Furthermore, Frontline’s expansion of its fleet positions it well to cater to growing shipping demand in the crude oil industry.

Frontline stock has a dividend yield of 12.11%, far more than the energy sector’s average of 3.75%.

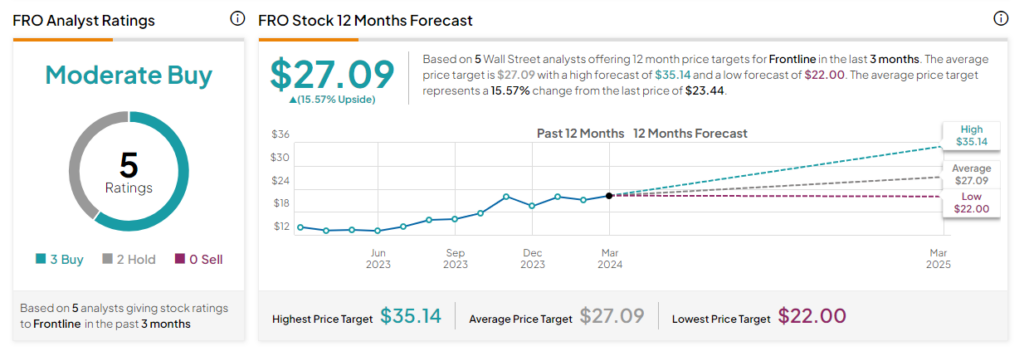

On TipRanks, FRO has received three Buy and two Hold recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target on FRO stock of $27.09 implies 15.57% upside potential. The stock has gained 56.3% over the past year.

Is KRP a Good Stock to Buy?

KRP is an oil and gas mineral and royalty company. Its strong footing in the Permian Basin and the acquisition of mineral rights assets in that region (closed in September 2023) are expected to support its production numbers.

The stock has an impressive dividend yield of 11.2%, compared with 3.75% for the energy sector.

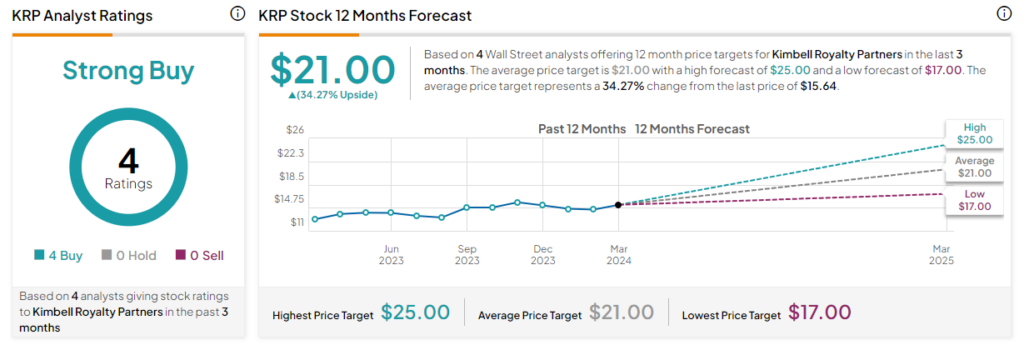

Overall, Kimbell’s Strong Buy consensus rating is backed up by four Buy ratings. The average price target of $21, points to a 34.3% potential upside in the next 12 months. KRP stock is up 21.5% over the past year.

Concluding Thoughts

Investors seeking a reliable passive income stream could consider both FRO and KRP stocks. Both companies boast an impressive dividend yield and remain well poised for growth in the near term. Furthermore, both stocks carry an Outperform Smart Score of eight, which points to their potential to beat the broader market.