Franco-Nevada announced it has published its 2021 Asset Handbook and 2021 Environmental, Social and Governance (“ESG”) Report. The Asset Handbook gives an overview of Franco-Nevada’s (FNV) portfolio of royalties and streams.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company has delivered an impressive performance. Since its IPO in 2007, it has managed to achieve an absolute return of over 860% and a compound annual growth rate of almost 20%. What’s more, revenue topped $1 billion for the first time in 2020.

Franco-Nevada’s portfolio is diversified, with no asset or operator exceeding 13% of revenue, supporting 2021’s strong growth outlook and the five-year forecast.

Additionally, Franco-Nevada’s annual ESG report describes its achievements in 2020 and commitment to improving its ESG performance. The gold company has been ranked #1 by Sustainalytics out of 84 precious metals companies and rated “AA” by MSCI.

Franco-Nevada’s President and CEO Paul Brink said, “We are proud to report on Franco-Nevada’s sector leading ESG performance and our new programs and commitments that we believe will continue this leadership. We strive to increase the quality of our Asset Handbook each year knowing it is a helpful resource for analysts and investors on our diverse asset base.” (See Franco-Nevada stock analysis on TipRanks)

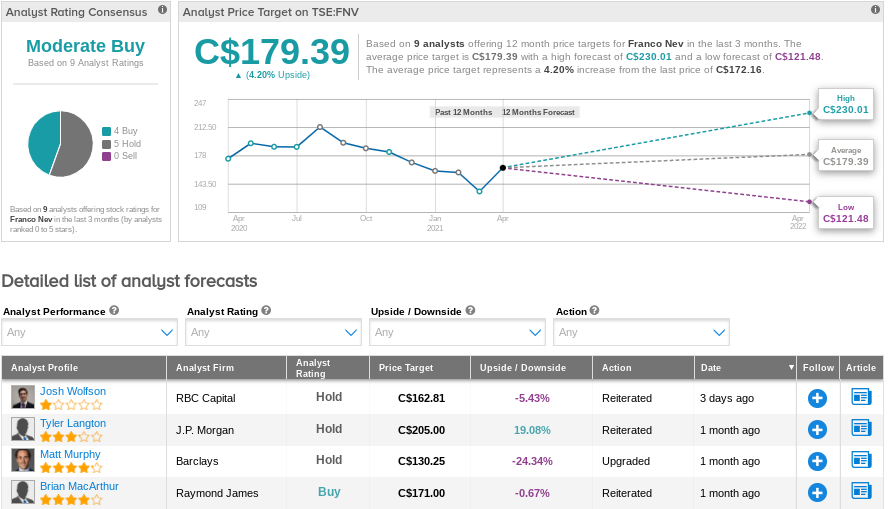

A month ago, J.P. Morgan analyst Tyler Langton reiterated a Hold rating on the stock with a price target of C$205.00 (19.1% upside potential).

Langton expects Franco-Nevada to report EPS of C$0.92 for 1Q 2021.

Overall, consensus among Wall Street analysts is a Moderate Buy based on 4 Buys and 5 Holds. The average analyst price target of C$179.39 implies 4.% upside potential to current levels. Shares of Franco-Nevada have soared over 11% over the past month.

Related News:

Aphria Shareholders Approve Tilray Merger

Peloton Shares Down 6% Pre-Market On US Regulator Warning

Anglo Pacific Group Announces Results For Fiscal Year 2020