Foxconn, one of the biggest contract electronics manufacturers, is building the world’s largest superchip factory for Nvidia (NVDA) in Mexico. One of Foxconn’s senior executives broke the news yesterday, stating that the mega factory will manufacture Nvidia’s GB200 chips to meet the enormous demand for Nvidia’s Blackwell platform.

Here’s How Foxconn’s Capabilities Will Aid Nvidia’s GB200

Foxconn is well known as iPhone maker Apple’s (AAPL) assembler and supplier. The Taiwanese company also makes servers, giving it a big push in the current AI (artificial intelligence) boom. Foxconn also manufactures advanced liquid cooling and heat dissipation technologies that are complementary to Nvidia’s GB200 server infrastructure.

Nvidia’s Blackwell chips are expected to start selling in the fourth quarter. Recently, NVDA CEO Jensen Huang noted that the demand for Blackwell chips is “insane.”

The Blackwell chips boast 2.5x more computing power than the currently available Hopper chips. The Blackwell chips are expected to accelerate the generative AI capabilities for corporates as they launch newer versions and advanced gen-AI technology.

Is NVDA a Good Stock to Buy Now?

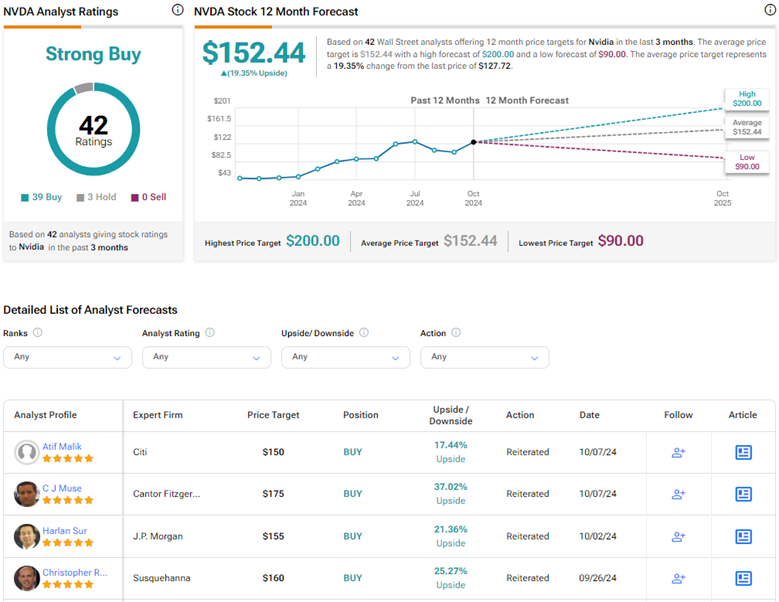

Wall Street is highly optimistic about NVDA’s stock trajectory. On TipRanks, NVDA stock has a Strong Buy consensus rating based on 39 Buys and three Hold ratings. The average Nvidia price target of $152.44 implies 19.4% upside potential from current levels. Meanwhile, NVDA shares have gained nearly 158% so far this year.