Fortune Brands Home & Security has agreed to acquire Larson Manufacturing, a leading brand in the U.S. storm door market, for about $660 million. In addition, Fortune Brands renamed its Doors & Security segment to Outdoors & Security to better align with its growth strategy and represent its brands.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Fortune Brands (FBHS) said that the Larson transaction “is immediately accretive and expected to add between $0.14 to $0.20 to 2021 earnings per share, net of interest expense and purchase price amortization.” The company expects the deal to close within the next 30 days. Following the acquisition, Larson will join Fortune Brands’ renamed Outdoors & Security segment.

Fortune Brands’ CEO Nicholas Fink said that “The acquisition of Larson is aligned with our strategic focus on the fast-growing outdoor living space.” He added that “There is tremendous potential to leverage the innovative products at Larson with our Therma-Tru and Fiberon offerings to provide a total exterior door system and capitalize on outdoor living trends such as multi-season rooms.” (See FBHS stock analysis on TipRanks).

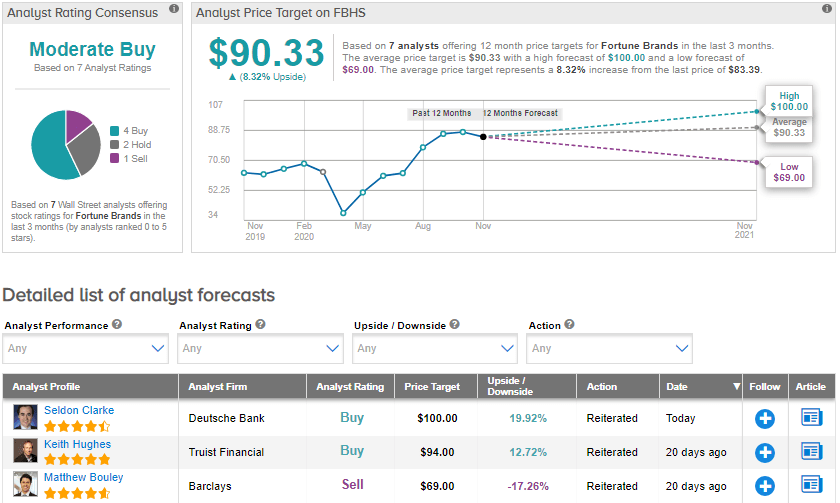

On Nov. 18, Deutsche Bank analyst Seldon Clarke raised the stock’s price target to $100 (19.9% upside potential) from $96 and maintained a Buy rating, reflecting accretion from the Larson acquisition.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 4 Buys, 2 Holds and 1 Sell. The average price target stands at $90.33 implying upside potential of about 8.3% to current levels. Shares have increased by about 27.6% year-to-date.

Related News:

Online Education Provider K12 Changes Name to Stride; Announces Two Acquisitions

IBM To Acquire SAP Firm TruQua To Bolster Hybrid Cloud Growth

Installed Building Snaps Up WeatherSeal Insulation; Street Is Bullish