American industrial technology conglomerate Fortive Corporation (FTV) announced its plan to split into two strategic units and focus on the growth of both independent, publicly-listed companies. Fortive will spin off its Precision Technologies Businesses into a new company (NewCo) and leverage the secular growth trends in the test and measurement, specialty sensors, and aerospace and defense subsystems markets.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

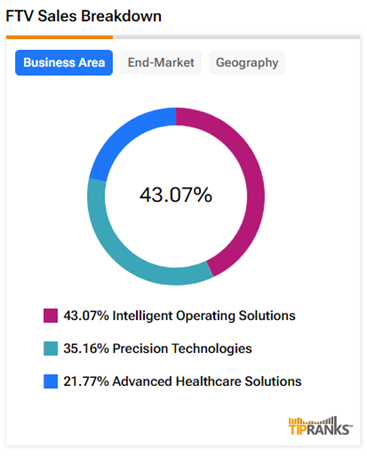

Meanwhile, Fortive will retain the Intelligent Operating Solutions and Advanced Healthcare Solutions businesses, focusing on a resilient growth portfolio with recurring revenues. As seen in the graph below, these two businesses account for a significant proportion of the company’s sales.

FTV shares jumped over 4.6% in after-hours trading yesterday on the news.

Fortive Aims to Strengthen its Financial Position

Fortive expects to complete the spin-off by the fourth quarter of 2025, subject to certain closing conditions. The spin-off will be structured in a tax-free way for shareholders.

Until then, Fortive intends to spend roughly 75% of its free cash flows on share buybacks. The remaining 25% will be used for paying regular cash dividends and reducing debt. This will help Fortive to maintain a strong investment-grade balance sheet. Notably, FTV stock pays a regular quarterly dividend of $0.08 per share, reflecting a modest yield of 0.42%.

Additionally, Fortive reaffirmed its Q3 FY24 and full-year Fiscal 2024 guidance, which it set forth during the second-quarter results.

Fortive Announces Leadership Transition

Along with the strategic restructuring, Fortive also announced a leadership transition that will take effect with the spin-off. Fortive’s current CEO, President, and Director, James A. Lico, will retire at the time of completion of the spin-off. He will be succeeded by Olumide Soroye, current President and CEO of the Intelligent Operation Solutions segment. Also, Fortive’s CFO Chuck E. McLaughlin will retire by the end of the first quarter of Fiscal 2025.

At the same time, Tami Newcombe, who is leading the Precision Technologies and Advanced Healthcare Solutions segments, will assume the role of the President and CEO of the NewCo.

Is FTV a Buy?

Ahead of the planned spin-off, analysts are cautiously optimistic on Fortive stock. On TipRanks, FTV stock has a Moderate Buy consensus rating based on five Buys and two Holds. The average Fortive price target of $83.29 implies 16.2% upside potential from current levels. FTV shares have declined 2.4% so far this year.

It is important to note that these ratings and price targets could change as analysts review Fortive’s strategy to split the company.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue