Ford Motor Co. (NYSE:F) is facing prolonged challenges in its electric vehicle (EV) ambitions. As per a Wall Street Journal report, the legacy automaker is mulling over halting one assembly line shift for its F-150 pickup trucks. The pause could begin today, October 16, and will affect 700 jobs at the Dearborn, Michigan, plant.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reportedly, the shift cancellation is called “temporary,” but no timeline is given as to when it could be resumed. The declining demand for EVs worldwide has pushed Ford to take this step. A company spokeswoman has cited multiple reasons for the halt, including supply chain constraints and quality checks. She also confirmed that the decision has no bearing on the ongoing UAW strikes.

Meanwhile, Ford’s EV deliveries slumped in the September quarter. The company has postponed its delivery targets for manufacturing 600,000 EVs to 2024.

Additionally, the continual cutting of EV prices by Tesla (NASDAQ:TSLA) has led to heated competition. The bottom lines of EV manufacturers could see material impacts in the foreseeable future due to increased labor costs stemming from the UAW contract negotiations. The UAW’s expanded strikes at Ford’s facilities may put the automaker’s sales in jeopardy.

Is Ford Safe to Invest In?

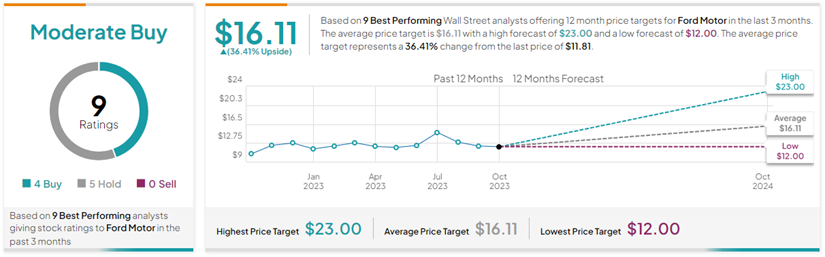

Of the nine Top Analysts who recently rated Ford stock, four have a Buy rating against five Hold ratings. Top Wall Street analysts are those awarded higher stars by the TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings).

Based on these analysts’ views, Ford has a Moderate Buy consensus rating on TipRanks. Also, the average Ford Motor Co. price target of $16.11 implies 36.4% upside potential from current levels. Despite the mounting troubles, F stock has gained 10.1% so far this year.