Ford Motor Company (NYSE: F), one of the top EV stocks on TipRanks, has revealed its plan to nearly double the production of its F-150 Lightning pickup at the Rouge Electric Vehicle Center in Dearborn to 150,000 trucks annually.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Following the news, shares of the American multinational automobile manufacturer jumped 11.7% to close at $24.31 on Tuesday.

Through the increased production, the company will cater to the high demand for its F-Series, the first all-electric version of America’s best-selling vehicle. Notably, from Thursday, the first phase of reservations will be converted into orders for the F-150 Lightning, and gradually, all reservations will be converted in a phased manner over the next few months.

Official Comments

President of the Americas & International Markets Group at Ford Motor, Kumar Galhotra, said, “With nearly 200,000 reservations, our teams are working hard and creatively to break production constraints to get more F-150 Lightning trucks into the hands of our customers.” The reality is clear: People are ready for an all-electric F-150 and Ford is pulling out all the stops to scale our operations and increase production capacity.”

Moves to Ramp Up Production

Staff at various units, including manufacturing, purchasing, strategy, product development, and capacity planning are looking for ways to ramp up production.

Additionally, Ford is in discussions with its key suppliers and own manufacturing facilities to find ways to enhance the production capacity of battery cells, battery trays, and electric drive systems.

Future Plans

Ford has committed to invest over $30 billion in electric vehicles through 2025, with the aim of establishing the top position as an electric vehicle maker in North America over the next two years. Markedly, within 24 months, Ford’s global production capacity is likely to be 600,000 battery-electric vehicles annually.

Along with ramping up production of the Lightning, Ford recently disclosed its plan of tripling Mustang Mach-E production and expects to reach more than 200,000 units per year by 2023. Also, Ford’s all-electric van, the 2022 E-Transit, will be available for sale early this year.

Markedly, Ford is also modernizing some of its auto production facilities, with a total investment of $11.4 billion.

Wall Street’s Take

On January 4, Bank of America Securities analyst John Murphy maintained a Buy rating on the stock and lifted the price target to $26 (6.95% upside potential) from $22.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 9 Buys, 5 Holds, and 3 Sells. The average Ford price target of $19.88 implies 18.22% downside potential from current levels. Shares have gained 71.7% over the past six months.

Website Traffic

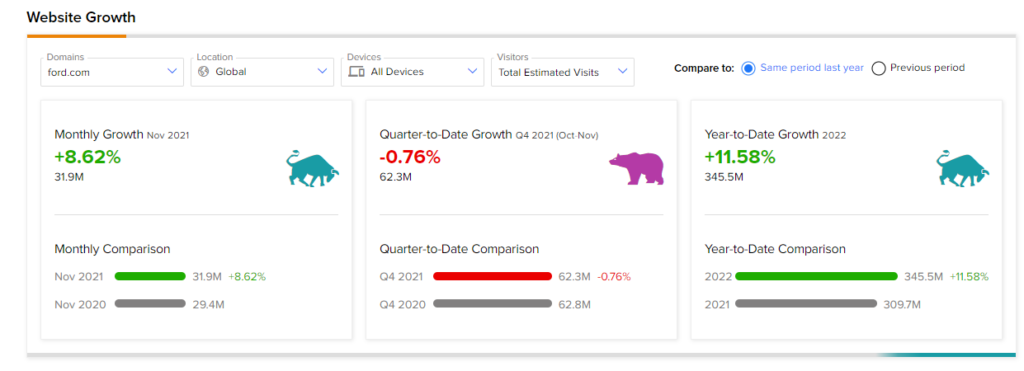

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Ford’s performance this quarter.

According to the tool, the Ford website recorded an 8.62% increase in global visits in November compared to the same period last year. In contrast, a quarter-to-date comparison showed a decline of 0.76% compared to Q4 2020, while year-to-date website traffic growth stands at 11.58%.

Download the TipRanks mobile app now

Related News:

Jazz Awarded Orphan Drug Exclusivity for Xywav

Amyris & ImmunityBio Conclude Joint Venture; Shares Jump

Genprex Granted Fast Track Designation for REQORSA; Shares Jump 167%