Shares of Ford Motor rose by almost 5% in Wednesday’s extended trading session after the US vehicle maker said it expects to post an adjusted profit for the full-year 2020 driven by robust demand for pickup trucks and SUVs.

As part of its third-quarter results, Ford (F) said that it now anticipates fourth-quarter adjusted EBIT to be between break-even and a $500 million loss, down from both the third quarter and year-ago period. Based on the guidance, the company forecasts positive adjusted EBIT in 2020 following previous expectations for a loss in the fourth quarter and for the full year.

In the third quarter, Ford reported an adjusted profit of $3.6 billion, or 65 cents a share, beating the 19 cents analysts had expected. The company’s adjusted EBIT margin in the reported quarter was 9.7%, which was nearly 5 points higher than in the prior year and above the 8% target Ford has set itself to attain and sustain over time.

The vehicle maker said that the robust third-quarter performance was driven by the company’s decision two years ago to reallocate capital to franchise strengths, including pickup trucks, SUVs, commercial vehicles and iconic passenger vehicles, while phasing out unprofitable sedans.

“We know that there’s huge value to be unlocked as we turnaround our automotive operations,” said Jim Farley, Ford’s CEO. “There will be additional opportunity when we start growing again, which we will do with products and services customers can’t resist.”

Farley added that electric vehicles are fundamental to the company’s future across its line up, including in commercial vehicles, and in the Lincoln line. He disclosed that Ford will launch a new, all-electric Transit van for global markets in November.

“By the end of the year, customers will be able to choose from12 hybrid and fully electric vehicles around the globe and there is much more to come,” Farley said. “We intend to set Ford apart in EVs with capabilities that reach across our 4 product portfolio, like an all-electric F-150 in 2022 that will be a rugged and affordable work pickup, not just a lifestyle vehicle.”

Ford generated $6.3 billion in adjusted free cash flow during the third quarter, as vehicle production reached pre-pandemic levels. The company ended the period with cash of almost $30 billion and total liquidity of more than $45 billion after fully repaying $15 billion in revolving credit drawn down in Q1 to maintain financial flexibility at the outbreak of the pandemic.

F shares, which have seen a steady recovery since hitting a low in March, are still down 17% on a year-to-date basis. (See Ford Motor stock analysis)

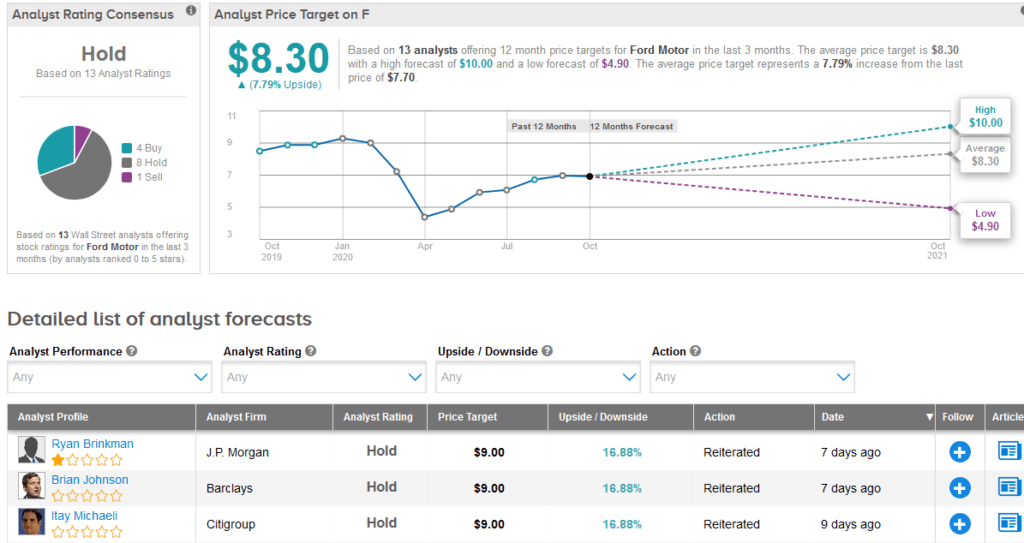

Ahead of the financial results, JPMorgan analyst Ryan Brinkman last week raised the stock’s price target to $9 (17% upside potential) from $7, but maintained a Hold rating.

Brinkman increased the company’s Q3 estimates to reflect the faster-than-expected pace of recovery in the global auto industry, as demonstrated by “strongly” higher sales, production, and used car prices.

The rest of the Street is in line with Brinkman’s sidelined outlook. The Hold analyst consensus shows 8 Holds, 4 Buys and 1 Sell. That’s alongside a $8.30 average analyst price target, indicating upside potential of about 8% from current levels.

Related News:

Boeing Posts Quarterly Loss As Air Travel Halt Dents Sales; Shares Dip

Amazon Hires 100,000 Seasonal Workers Ahead Of Peak Holiday Period

Fiverr Surges In Pre-Market On Earnings, Revenue Beat