Ford Motor Company (F) a global automobile company announced plans to ramp up investment in the Electrical Vehicle segment to a massive $30 billion by 2025. Shares jumped 8.6% to close at $13.90 on May 26.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

As part of the Ford+ plan discussed at the investor day event, the company announced an increase in EV spending to $30 billion from the earlier stated budget of $22 billion.

The company projects 40% of its global vehicle sales to be all-electric by 2030, including the Mustang Mach-E, which accounts for approximately 70% of new sales, and the newly launched electric F-150 Lightning, which has around 70,000 customer reservations since its unveiling last week. (See Ford Motor stock analysis on TipRanks)

The event also saw the launch of Ford Pro, a vehicle services and distribution business dedicated to the high productivity requirements of commercial and government customers. Additionally, Ford hopes to have about 1 million vehicles that are capable of receiving over-the-air system updates on the road by the end of the current year. The company also provided a projected revenue forecast of $45 billion by 2025, and an adjusted EBIT margin forecast of 8% in 2023.

Ford’s CEO Jim Farley said, “I’m excited about what Ford+ means for our customers… We will deliver lower costs, stronger loyalty and greater returns across all our customers.”

Farley added, “This is our biggest opportunity for growth and value creation since Henry Ford started to scale the Model T, and we’re grabbing it with both hands.”

Following the company’s ramped-up electrification announcement, Wells Fargo analyst Colin Langan reiterated a Buy rating on the stock and said that the company’s EBIT forecast of 8% by 2023 is “a modest positive surprise,” and added that he was happy with “still more positive EV surprises today with the 40% all-electric target by 2030 and increased EV spend” along with the other recent EV announcements.

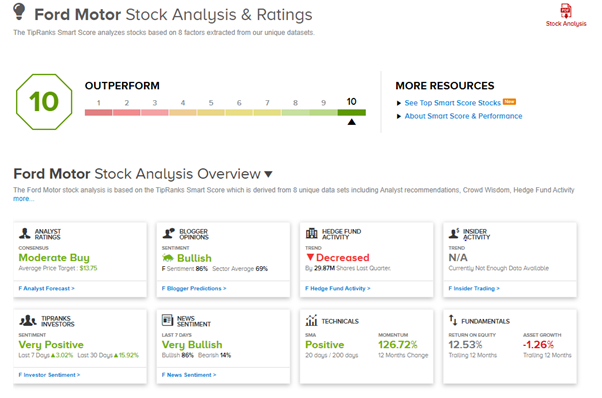

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 9 Buys, 5 Holds, and 1 Sell. The average analyst price target of $14.18 implies 2% upside potential to current levels. Shares have gained 130.5% over the past year.

Ford scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Columbus McKinnon Delivers Solid Q4 Results; Provides Upbeat Guidance

Bed Bath & Beyond Partners with DoorDash to Expand Same-Day Delivery

Pfizer and Myovant Obtain FDA Approval for MYFEMBREE