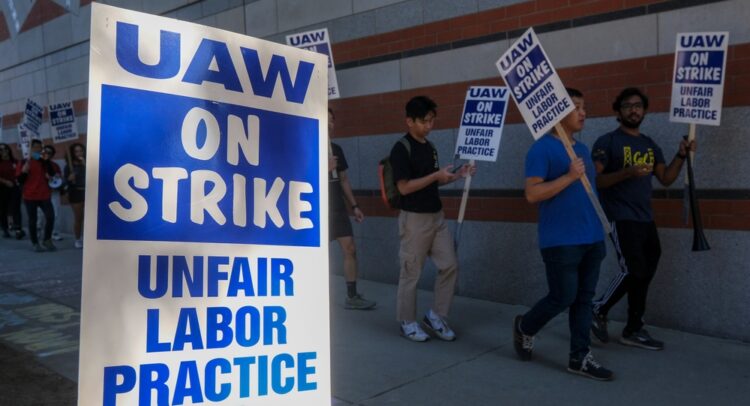

Amid the ongoing battle between the “Big Three” automakers and the United Auto Workers (UAW) union, Ford Motor Co. (NYSE:F) presented a revised offer to the UAW on August 31. As per Ford CEO Jim Farley, the offer is very “generous,” with meaningful pay increases, the elimination of the wage tier system, and the opportunity to reach the highest wage scale faster. Even so, UAW President Shawn Fain has dismissed Ford’s counter-offer, calling it inadequate on the grounds of job security proposals, quality of life proposals, and retiree payout proposals.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Terms of the Revised Offer

As per the revised terms, Ford’s hourly workers will get a straight 15% raise in terms of wages as well as other benefits. The increase would result in hourly workers getting paid an average of $92,000 in the first year, up from $78,000 in 2022. Moreover, workers would get health coverage worth $17,500 and additional benefits of up to $20,500 in year one.

Further, in the first year, full-time permanent employees could receive up to $98,000 in wages, bonuses, cost of living adjustments, ratification bonuses, profit sharing, and overtime. Farley noted that the revised terms of the contract are comparable to those of the likes of Tesla (NASDAQ:TSLA) and foreign automakers that have operations in the U.S.

Believing that the current proposal is significant, Farley has reiterated that the company would not make an offer that would hinder its ability to invest and grow the business. The CEO is confident that both Ford and UAW employees could together participate in the historical transformation of the American auto industry.

Strike Possibility Still Persists

However, since Fain rejected the revised proposal last night, it remains to be seen how Ford will go ahead with further negotiations and dialogues with the union. Fain also joked about Ford’s offer, saying, “I hope these shareholders know how to work on an assembly line because those are going to be the only people left to build cars come September 15.”

The UAW has vowed to go on strike effective September 15 should the Big Three automakers fail to seal revised contracts. While Ford’s counter-offer has been dismissed, the UAW has filed charges against General Motors (NYSE:GM) and Stellantis (NYSE:STLA). In its charges with the National Labor Relations Board, the UAW has cited unfair labor practices and negotiations conducted in bad faith.

Recently, Morgan Stanley analyst Adam Jonas noted that the UAW-related labor costs account for only 4% of the Big Three automakers’ global revenues. Even if negotiations turn rough, higher labor costs could be manageable through strategizing and capital discipline measures. Jonas concluded that these short-term labor issues are less significant when considering the long-term benefits to shareholders.

Is Ford a Buy or Sell Stock?

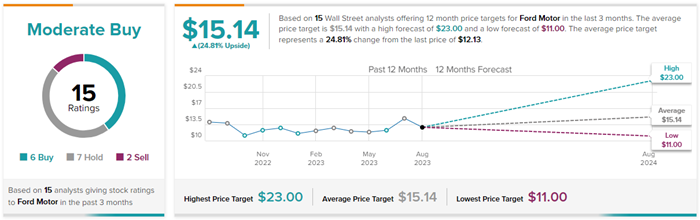

Wall Street remains cautiously optimistic about Ford’s trajectory. With the ongoing labor issues, price wars, and other macro challenges persisting, analysts have mixed views on Ford stock. Year-to-date, F stock has gained 13.1%.

On TipRanks, Ford has a Moderate Buy consensus rating based on six Buys, seven Holds, and two Sell ratings. The average Ford Motor Co. price target of $15.14 implies 24.8% upside potential from current levels.