Ford Motor Company (F) is hitting the brakes on its electric vehicle (EV) ambitions with a major strategic shift. The automaker recently announced it will cancel its plans for a large electric SUV and delay the launch of its next-generation pickup truck. This decision is part of a broader pivot as Ford adapts to the slower-than-expected growth in EV demand. The company now expects to take a hefty $1.9 billion in special charges and write-downs related to these changes, according to Reuters.

Ford Scraps Electric SUV and Delays Pickup

According to the Wall Street Journal, Ford’s CEO, Jim Farley, explained the move, stating, “Based on where the market is and where the customer is, we will pivot and adjust and make those tough decisions.” The electric three-row SUV, which was initially slated for a 2025 debut, is being scrapped due to tough pricing pressures and a market that has not embraced EVs as quickly as anticipated. Instead, Ford will focus on a hybrid gas-electric version for this segment. The new electric pickup truck, which was originally planned for release in 2025, is now set for a 2027 launch to leverage lower-cost battery technology, according to Reuters.

Ford Adapts to Market Realities

Despite the setbacks, Ford is not abandoning its EV plans entirely. The company is moving forward with other electric models, including a commercial van set to debut in 2026 and a new mid-size electric pickup. Farley highlighted the importance of a talented team in California working on a new EV architecture, which will contribute to more affordable and competitive models in the future.

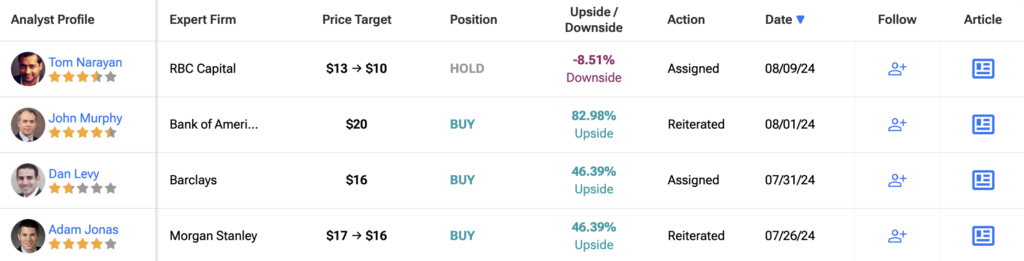

Is Ford Stock a Buy Right Now?

Looking at the stock, analysts are holding a cautiously positive view on Ford. They’ve got a Moderate Buy rating, split between five Buys, six Holds and one Sell. Despite Ford’s stock slipping by 2% in the past year, the average F price target of $14.20 suggests there could be a 30.10% upside from where the stock is now.