Ford Motor Co. (NYSE:F) has tapped Lisa Materazzo as the global chief marketing officer (CMO), as the legacy automaker seeks to advance its EV (electric vehicle) ambitions. Materazzo served as the North American marketing executive for Toyota (NYSE:TM) and has been with the Japanese automaker for nearly 20 years.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Ford’s CMO position remained vacant for almost a year after Suzy Deering left the company in late 2022. Materazzo will report to CEO Jim Farley, leading advanced product planning and marketing efforts across Ford’s three main divisions. In 2022, Ford broke down the brand into three noteworthy divisions, namely Ford Blue (combustion models), Ford Model e (EV models), and Ford Pro (commercial vehicles).

Ford Makes Other Executive Shuffles

Along with hiring a new CMO, Ford made two other executive shuffles. William Clay “Will” Ford III, son of the executive chair Bill Ford and great-grandson of founder Henry Ford will take the role of general manager of Ford Performance. With nearly a decade of experience in venture capital investing, Will Ford will be responsible for building Ford’s motorsports and racing division into a lifestyle brand.

At the same time, Elena Ford, who has been serving as Ford’s chief customer experience officer, was named chief dealer engagement officer. She will work closely with the company’s roughly 10,000 dealers worldwide. Elena, the great-great-granddaughter of Henry Ford, has been with the company since 1995 and has served in numerous roles.

American car makers are vying to capture a larger share of the global EV market, in which China currently has a leading position. The Biden Administration is also pushing automakers to focus more on EVs and hybrid cars as America tries to become more carbon-free. With a new CMO, Ford hopes to revitalize the brand and make an impressive impact in the EV space.

Is it Good to Buy Ford Stock?

Yesterday, UBS analyst Patrick Hummel initiated coverage of F stock with a Buy rating. The analyst set a price target of $15 (20.5% upside) on the stock. Hummel noted that the Big Three automakers currently face the threat of a potential UAW strike. Even so, a 4-week strike possibility is already priced into the current stock prices.

Hummel believes a strike might not go beyond a certain point, as automakers and union workers could reach a solution soon. Following this, sector margins would improve, and shares could return to near prior peak levels despite the mid-term challenges.

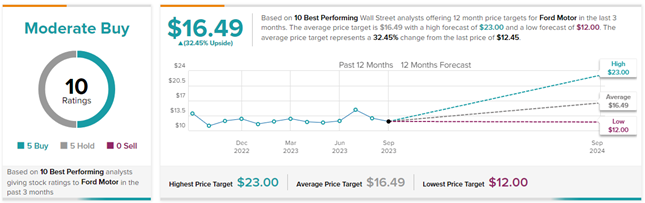

Including Hummel, nine other Top Analysts have recently rated Ford stock. The top analysts are split with five ratings each of Buy and Hold views. Top Wall Street analysts are those who are awarded higher stars by TipRanks’ Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings).

Based on these views, Ford has a Moderate Buy consensus rating. Also, the average Ford Motor Co. price forecast of $16.49 implies 32.5% upside potential from current levels. Meanwhile, F stock has gained 16% so far this year.