Ford (NYSE:F) and its South Korean partners EcoProBM and SK On Co Ltd are investing C$1.2 billion to build a cathode manufacturing plant in Becancour, Québec, Canada, to strengthen the legacy automaker’s supply chain. Canada’s federal government and the province of Québec will each provide the consortium of Ford and South Korean companies conditional loans of C$322 million.

Ford’s New Battery Material Plant

The production at the Québec factory is expected to begin in the first half of 2026. The factory will have the capacity to produce 45,000 tonnes of cathode active materials (CAM) per year for Ford electric vehicles (EVs). The new facility marks Ford’s first investment in Québec and is projected to create over 345 jobs.

The new plant will manufacture cathode active materials and high-quality Nickel Cobalt Manganese (NCM) for rechargeable batteries that target greater performance levels and improved EV range compared to existing products. The Québec facility is part of Ford’s plan to localize key battery raw material processing in regions where it manufactures EVs.

Interestingly, rival General Motors (NYSE:GM), along with South Korea’s POSCO Future M, is also building a factory in Becancour, Québec, to produce CAM for EV batteries.

Ford and General Motors are securing raw materials required to meet their ambitious EV production targets. Several automakers and battery producers are moving their supply chain to North America to take advantage of the U.S. Inflation Reduction Act, which offers tax credits for vehicles whose battery components are manufactured or assembled in North America.

Is Ford a Buy, Sell, or Hold?

On Tuesday, Morgan Stanley analyst Adam Jonas reiterated a Buy rating on Ford Motor stock with a price target of $16 after documents released by China’s market regulators revealed that the auto giant plans to set up a new-energy passenger car joint venture with state-owned Chongqing Changan Automobile.

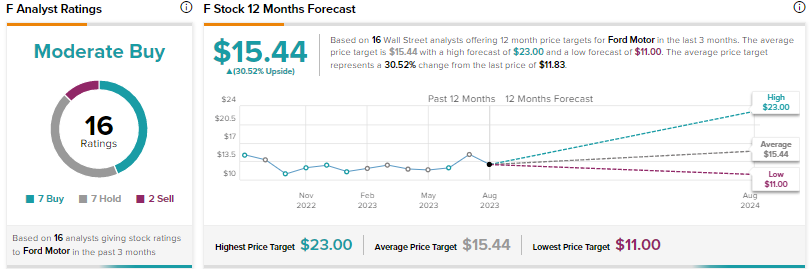

Wall Street’s Moderate Buy consensus rating on Ford is based on seven Buys, seven Holds, and two Sells. The average price target of $15.44 implies 30.5% upside. Shares have risen just 1.7% since the start of this year.