Shares of Fly Leasing Limited jumped 27.5% on March 29 after the aircraft leasing investment company inked a deal with Carlyle Aviation Partners to be acquired for an enterprise value of $2.36 billion.

Fly Leasing (FLY) CEO Colm Barrington said, “This transaction represents strong value for FLY shareholders at a time when airlines are facing an extremely difficult environment and smaller aircraft lessors are disadvantaged in the debt markets.”

Carlyle Aviation Partners, the commercial aviation investment and servicing arm of the Carlyle Group’s (CG) $56 billion Global Credit platform, manages a leasing portfolio, with 246 aircraft owned. Notably, Fly Leasing’s portfolio of 84 aircraft will be added to this.

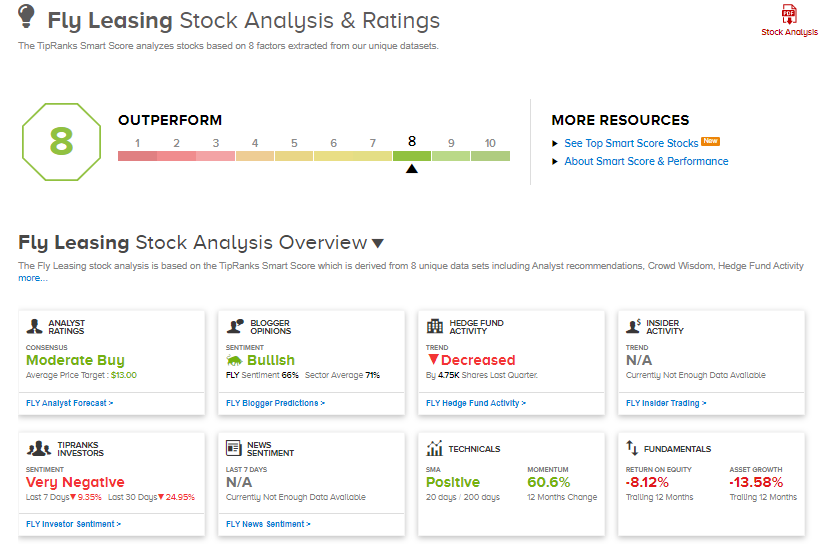

Per the terms of the agreement, Carlyle Aviation will pay $17.05 in cash for each share of Fly Leasing. The price tag represents a 29% premium to the company’s closing price on March 26. The total equity valuation stands at $520 million. (See Fly Leasing stock analysis on TipRanks)

The transaction, which awaits shareholders’ approval and certain regulatory approvals, is expected to close in the third quarter of this year.

On March 19, Deutsche Bank analyst Michael Linenberg increased the stock’s price target to $13 from $10 and maintained a Hold rating.

In a note to investors, Linenberg said that data points for airline travel “are all moving in the right direction.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 1 Buy versus 1 Hold. The average analyst price target of $13 implies 23% downside potential to current levels.

Fly Leasing scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Johnson & Johnson Signs Single-Shot COVID-19 Vaccine Deal With AVAT

Cognizant To Snap Up ESG Mobility, Boost Digital Automation

Medtronic Receives FDA Approval For Harmony TPV Therapy; Street Says Buy