AMD’s (NASDAQ:AMD) shares jumped over 4% at the time of writing after Piper Sandler reaffirmed its Buy rating on the stock and named it the top large-cap chip pick for the second half of the year. Five-star analyst Harsh Kumar highlighted the chip maker’s promising outlook and cited improvements in GPU supply and the strong performance of its MI300 chip, which is expected to generate over $4 billion this year.

This is due to key customers like Microsoft (MSFT), Meta (META), and Oracle (ORCL) ramping up their operations with the MI300. Kumar also mentioned that AMD has several new chips in the pipeline, with MI325 coming out later this year and MI350 in 2025. Both will feature next-gen memory. In addition, the MI400 will be released in 2026.

It’s worth noting that, so far, Kumar has enjoyed a 91% success rate on AMD stock, with an average return of 59.36% per rating. His current price target of $175 implies over 8% upside potential from current levels.

Is AMD a Buy, Sell, or Hold?

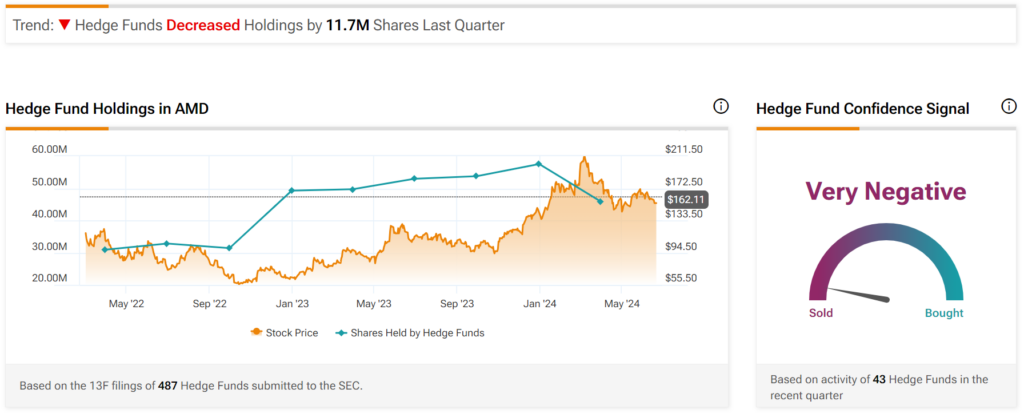

Overall, analysts have a Strong Buy consensus rating on AMD stock based on 29 Buys, seven Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 38% rally in its share price over the past year, the average AMD price target of $191.03 per share implies 18.04% upside potential. However, hedge funds see things differently.

When it comes to “smart money,” money managers don’t seem to be all that confident in AMD stock. Indeed, hedge funds decreased their holdings in the stock by 11.7 million shares in the last quarter. As a result, they have a very negative confidence signal, as indicated by the graphic below.