Crypto-crazed software company Microstrategy (MSTR) is out to buy all the Bitcoin it can get its hands on, and that has led to five-star BTIG analyst Andrew Harte praising its ambitious “21/21” plan to raise $42 billion over three years to increase its Bitcoin holdings. The strategy includes $21 billion from equity and $21 billion from fixed-income securities, hence the name. Since October 31, MicroStrategy has already raised $6.6 billion in equity and added 78,980 Bitcoin to its holdings, bringing its total to 331,200 tokens.

The company’s recent offering of convertible senior notes due 2029 was upsized to $2.6 billion from $1.75 billion, which shows just how popular its BTC-buying strategy has become. Harte commended the management team for capitalizing on market volatility to efficiently raise fiat currency in order to grow its Bitcoin stash. It also helps that Bitcoin has continued to rally. Since October 31, Bitcoin has climbed over 30% to $94,400 to increase the value of MicroStrategy’s Bitcoin holdings to more than $31 billion.

As a result, Harte raised his price target for MicroStrategy to $570, which equates to a roughly 20% upside from today’s closing price. It’s worth noting that, so far, Harte has enjoyed a 75% success rate on his stock ratings, with an average return of 63.8% per rating.

MSTR Is a Bitcoin Index that Generates Cash

Andrew Harte isn’t the only analyst who likes MSTR. Indeed, analyst Ramsey El-Assal previously praised the company’s strategy of using its software business’ profits to help build a Bitcoin reserve. He even went on to call the firm a Bitcoin index fund that generates its own cash. El-Assal highlighted MicroStrategy’s unique strategy for accumulating Bitcoin while also highlighting the potential for higher recurring revenue through a shift to subscription services in its software business.

Is MSTR a Good Stock to Buy?

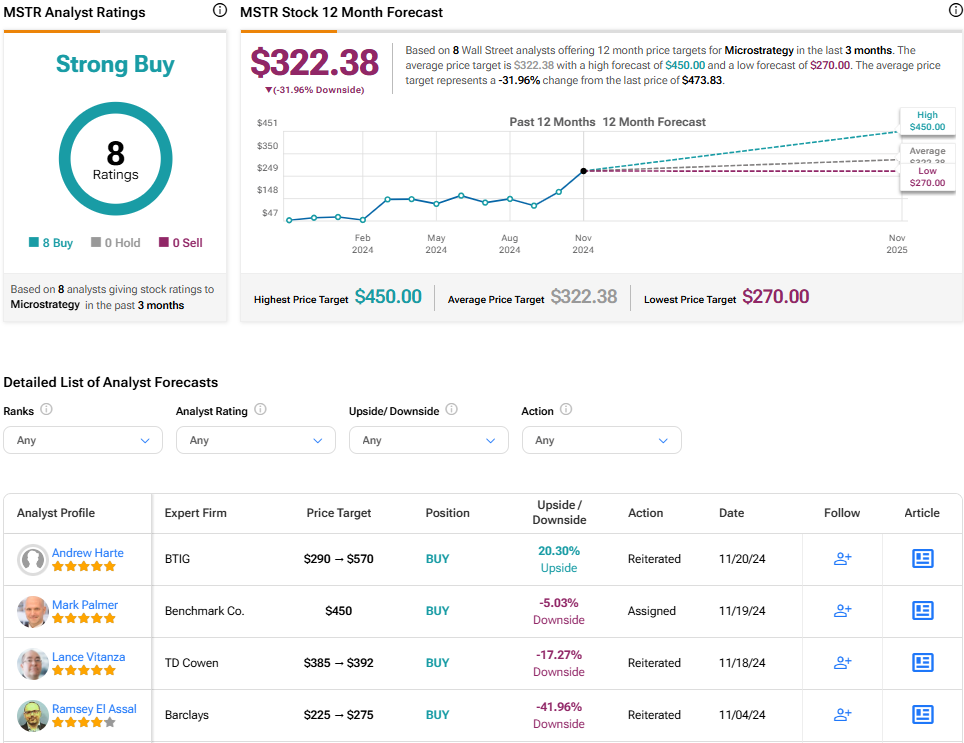

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on eight Buys assigned in the past three months, as indicated by the graphic below. However, after a 650% surge in its share price on a year-to-date basis, the average MSTR price target of $322.38 per share implies 32% downside risk.