Shares in First Solar (FSLR) popped 13% in Tuesday’s after-hours trading after the company reported a stellar earnings beat.

Specifically, Q3 GAAP EPS of $1.45 beat Street consensus by $0.83. Revenue of $928M surged 69.7% year-over-year, and topped Street expectations by $235.44M- primarily due to international project sales, and an increase in the volume of modules sold to third parties.

Cash, restricted cash, and marketable securities at the end of the third quarter totaled $1,671M, an increase of $29M from the prior quarter, with strong international project sales and module segment operating cash flows partially offset by capital expenditures and loan repayments.

“We delivered strong financial results for the third quarter,” said Mark Widmar, CEO of First Solar. “The dedication we continue to witness from our associates enabled us to expand module segment gross margin, close the sales of our Ishikawa, Miyagi, and Anamizu projects in Japan, and increase earnings per share quarter-over-quarter. This result reflects the strengths of our competitively advantaged CdTe modules and vertically integrated manufacturing process.”

Looking forward, First Solar reinstated guidance for the fourth quarter and provided implied full-year 2020 guidance. It is now guiding for Q4 EPS of $1.00-$1.50 on revenues of $540M-$790M vs consensus estimates of $1.17 EPS and $847M in revenue.

That takes FSLR’s implied FY 2020 guidance for EPS to $3.65-$4.15 and revenue of $2.6B-$2.9B (vs the Street at $2.88 EPS and $2.69B revenue). (See First Solar stock analysis on TipRanks)

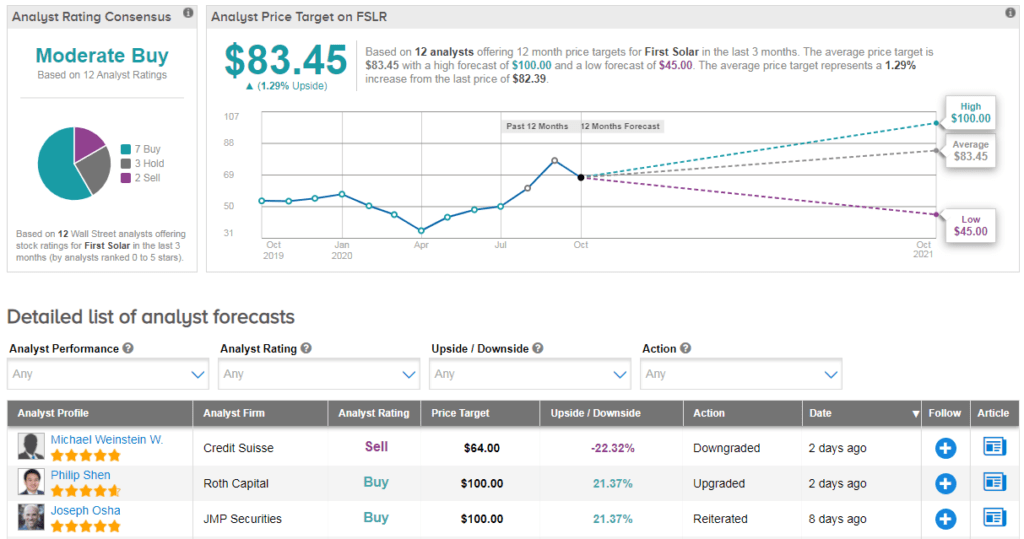

Year-to-date, First Solar shares are soaring 47%, and the stock scores a cautiously optimistic Moderate Buy Street consensus. The average analyst price target of $83 is in-line with current levels, suggesting limited upside potential lies ahead.

However Roth Capital Partners analyst Philip Shen has just upgraded the stock from buy to hold. That’s with a $100 price target. “Heading into third quarter results, we see the narrative around FSLR serving as a go-to company for customers seeking security of supply and reduced reliance on the Chinese supply chain gaining further momentum,” he explained.

Related News:

Amazon Hires 100,000 Seasonal Workers Ahead Of Peak Holiday Period

Restaurant Brands 3Q Profit Beats Estimates But Sales Drop; Shares Fall

AMD Seals $35B Deal To Buy Chip Rival Xilinx; Shares Drop