The TipRanks’ Top Hedge Fund Managers tool allows investors to track the investment decisions of leading financial experts. The tool ranks these professionals based on success rates, average returns, and the significance of their trades. In this article, we will focus on the three top picks – Fair Issac (NYSE:FICO), S&P Global (NYSE:SPGI), and Mastercard (NYSE:MA) – of the leading hedge fund manager Dev Kantesaria of Valley Forge Capital Management, L.P.

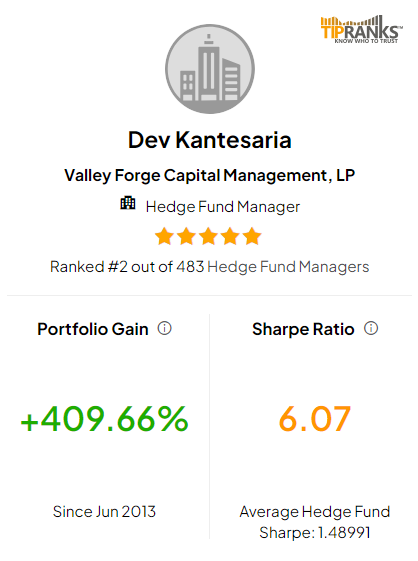

According to the rankings, Kantesaria is second among the 483 hedge fund managers evaluated by TipRanks. Furthermore, his portfolio has demonstrated remarkable performance, gaining 409.66% since June 2013, with an average return of 48.12% in the last 12 months.

Additionally, a hedge fund manager’s return on a portfolio is best measured by the Sharpe ratio, which measures the portfolio’s returns against its risks. A Sharpe ratio greater than one means that the portfolio has higher returns than risks. Kantesaria has a Sharpe ratio of 6.07.

With this background, let’s explore what the Street is saying about Kantesaria’s top picks.

Is FICO a Good Stock to Buy?

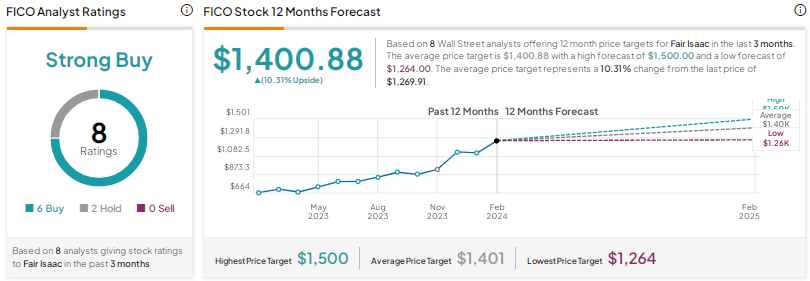

Fair Isaac is a data analytics company that developed the FICO credit scoring system widely used in lending decisions. With an exposure of 29.89%, FICO occupies the first position in Kantesaria’s portfolio.

FICO stock has a Strong Buy consensus rating based on six Buys and two Holds. Further, the average price target of $1400.88 implies a 10.3% upside potential to current levels. Shares of the company have gained 42% over the past six months.

Is SPGI Stock a Good Buy?

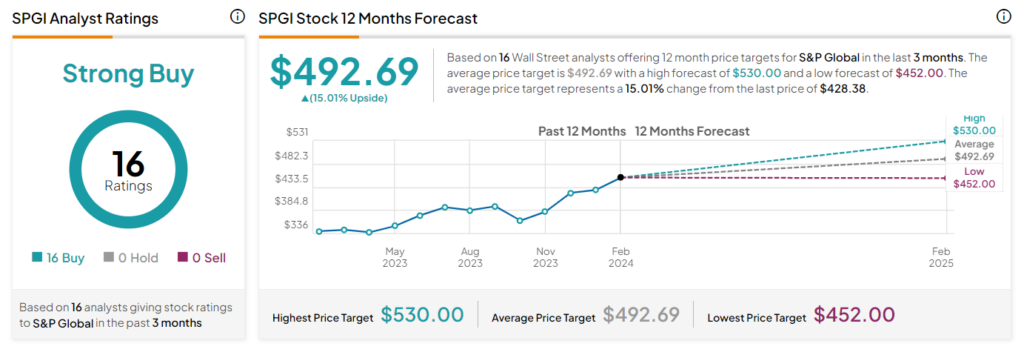

S&P Global is a leading financial information and analytics company. SPGI is the second-largest holding in Kantesaria’s portfolio, with an exposure of about 20.69%.

With 16 unanimous Buy ratings, SPGI stock commands a Strong Buy consensus rating. On TipRanks, the average SPGI stock price target of $492.69 implies 15.01% upside potential from current levels. Over the past six months, shares of the company have gained 9.12%.

What Is the Forecast for MA Stock?

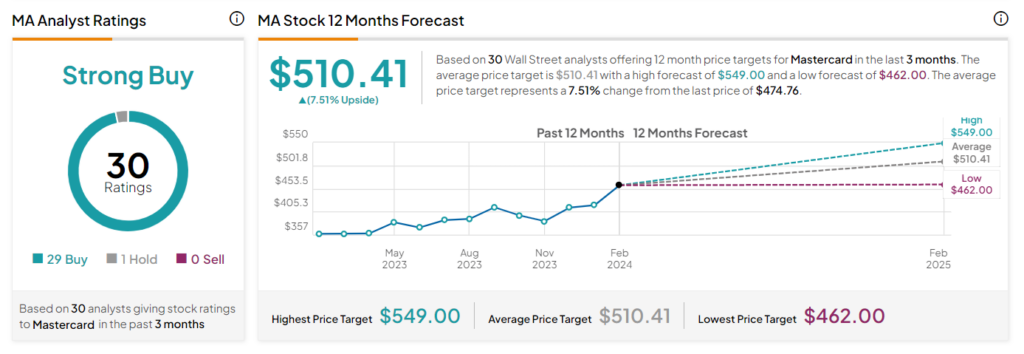

Mastercard is a global payment technology company that facilitates electronic funds transfers. The stock constitutes 17.97% of Kantesaria’s portfolio.

On TipRanks, MA stock has a Strong Buy consensus rating. This is based on 29 Buys and one Hold recommendation. The average price target of $510.41 implies 7.51% upside potential. Shares of the company have gained 14.6% over the past six months.

Interestingly, MA stock has a Smart Score of “Perfect 10” on TipRanks. Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX).

Concluding Thoughts

Kantesaria’s impressive portfolio gains may encourage investors to adopt his portfolio allocation strategy. By following the guidance of experts, investors can leverage their knowledge and make well-informed decisions.