Ferrexpo (GB:FXPO) issued an update stating that the Russian missile strikes have damaged the ‘state-owned electrical infrastructure’ leading to the production halt at the company’s operations.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The attack has impacted the power supply, and the region is operating only on essential services.

The company also confirmed that its workforce is safe and no injuries have been reported so far. It also continues to adhere to necessary safety precautions.

Ferrexpo, which is a leading iron ore pellets exporter, said that it is currently secured with adequate products, either in stock or in transit, to meet its sales volumes.

Last week, the company also announced its production report for the third quarter of 2022. The iron ore pellet production decreased by 68% on a year-on-year basis, as the company faced huge disturbances in its operations since the beginning of the Russia-Ukraine war.

Sales fell by 65% to 1 million tonnes in the third quarter of 2022.

An analyst at Liberum said, “iron ore shipments are expected to pick up in the fourth quarter while grain shipments are expected to fall, freeing up logistics and allowing Ferrexpo to raise production.”

Ferrexpo shares went down by almost 11% after the news yesterday but quickly gained some value back.

Where are Ferrexpo mines in Ukraine?

Ferrexpo is one of the largest employers in central Ukraine and a major contributor to its economy.

The company produces iron ore in Ukraine through three mines, Poltava, Yeristovo, and Belanovo. The company sells the end product to markets in Europe, the Middle East, and Asia from these mines.

Ferrexpo share price forecast

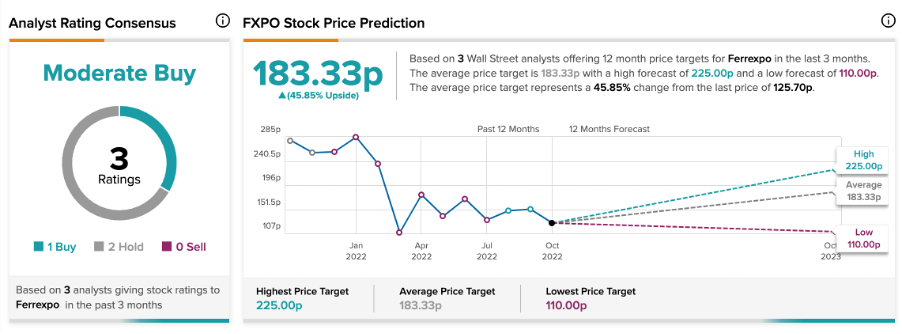

According to TipRanks’ analyst rating consensus, Ferrexpo stock has a Moderate Buy rating.

The FXPO target price is183.33p, with a high and a low forecast of 225p and 110p, respectively. The price target implies a change of 46% from the current price level.

Conclusion

Currently, the company is assessing the damage and will further update on how long the production downtime will continue.

The company is also in discussions to restart the water-bound export via ocean which was hampered after the war.