The Federal Reserve’s recent decision to maintain interest rates at 23-year highs for an extended period has prompted investors to reassess their portfolios to match the new expectations. While the whole market never agrees on one consensus as to which sector is the best to invest in, a new consensus suggests that shifting from growth stocks to defensive stocks is logical.

The Case for Defensive Stocks

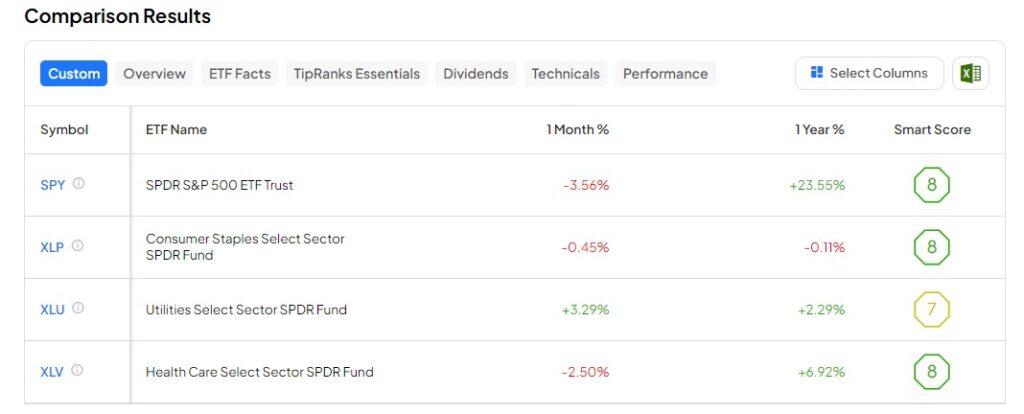

When the mood shifts towards defensive holdings, as it seems to be doing, investors often look to three of the S&P 500 sectors as a gauge to determine the overall performance of defensive stocks in general. The sectors are represented below by SPDR ETFs, with the SPDR S&P 500 ETF (NYSE: SPY) to be used as a market benchmark. The ETFs include the SPDR Consumer Staples Select Sector Fund (NYSE: XLP), the SPDR Utilities Select Sector Fund (NYSE: XLU), and the SPDR Healthcare Select Sector Fund (NYSE: XLV).

Over the past 12 months, the S&P 500 ETF outperformed the subsectors handily with a one-year return of 23.55%.

Factors Driving Interest in Defensive Stocks

Several factors exist that generally fuel interest in defensive stocks. One factor driving the shift now is the notion that rates will be higher for longer. This is important because elevated interest rates make stocks with consistent dividends more appealing. Several companies considered defensive, such as utility firms and consumer staples, are known for their reliable dividend payments.

Worry is another key driver that causes a shift to defensive plays. While many recent economic numbers haven’t supported these fears, economic growth measured by Gross Domestic Product (GDP) experienced a considerable decline in the first quarter, while consumer confidence has been on a slide for months. These economic reports have caused investors to feel vulnerable, further enhancing the potential for defensive stocks to thrive.

Key Takeaway

When the Fed acknowledged that a prolonged period of interest rates at current levels is probable, and confirmed ongoing economic uncertainties, it heightened market apprehensions for many. The concerns suggest that defensive stocks could be well-positioned to continue their outperformance relative to the broader market.

Defensive stocks’ stability, dividend yields, and relative immunity to economic cycles make them a compelling option for investors seeking a safe haven during uncertain times. And when money moves to the defensive sectors, such as consumer staples, utilities, and healthcare, momentum builds, potentially enhancing performance.