Shares of FedEx rose 6.6% on Friday after the courier company announced an increase in surcharge on international deliveries across certain destinations.

An unprecedented surge in delivery volumes amid the COVID-19 pandemic has allowed FedEx (FDX) to raise its rates. Meanwhile, the revised surcharges are expected to mitigate the impact of higher costs that resulted from restrictions imposed by countries to contain the spread of the coronavirus pandemic

On August 6, FedEx said it will double the per kilo surcharge on parcels from Hong Kong to the US effective from August 10. It will also increase the surcharge on parcels from Taiwan to the US to $1 from $0.22 per kilo. Additionally, the company will raise surcharges on shipments from the Philippines to $0.90 from $0.45.

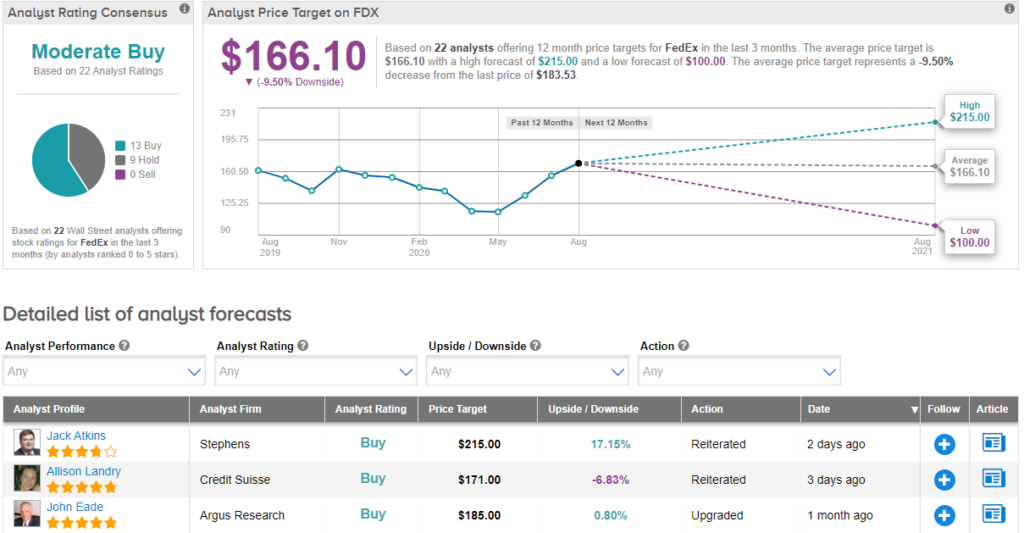

On August 7, Stephens analyst Jack Atkins raised the price target on FedEx to $215 (17.1% upside potential) from $180 and maintained a Buy rating, saying that the stock is his “Best Idea” for the rest of 2020. Atkins said that the setup for FedEx “is perhaps the best it has been since mid-2013” and he sees “increasingly positive demand and pricing signals”.

Overall, FDX has a Moderate Buy analyst consensus. Meanwhile, the average price target of $166.10 implies downside potential of 9.5% to current levels. (See FDX stock analysis on TipRanks).

Related News:

Groupon Soars 28% In Pre-Market On Stellar 2Q Beat

Stifel Lifts EPAM Systems’ PT After Strong 2Q Results

Cloudflare Beats 2Q Estimates On Strong Customer Growth