On Wednesday, the Federal Reserve announced that it would keep interest rates steady, which was as expected. As a result, rates remain in a range of between 5.25% to 5.5%. The policy-making committee also implied one interest rate cut in 2024 based on the central bank’s summary of economic projections. This news, combined with today’s cooler inflation data, led the S&P 500 (SPX) to a new intraday record.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In March, the Federal Reserve had projected Fed Funds rates of 4.6% and 3.9% for 2024 and 2025, respectively. Interestingly, the updated projection now stands at 5.1% and 4.1%, respectively. This means that the central banks expect rates to remain higher for a longer period of time than previously anticipated. However, its real GDP forecast for 2024 remained unchanged at 2.1%.

Furthermore, the central bank’s board members and presidents weighed in on PCE inflation and now expect it to be 2.6% in 2024. For reference, they had forecast 2.4% in the previous report. Core PCE inflation projections also increased to 2.8% versus 2.6%.

It’s clear that inflation continues to be stubbornly sticky. Nevertheless, with GDP expectations remaining flat, the Fed seems to believe the economy might avoid a recession, at least according to today’s report. In addition, it would appear that the Federal Reserve is giving the economy time to adjust to the current interest rates as they continue to gradually work their way through.

Jerome Powell Speaks

Federal Reserve Chair Jerome Powell said that the economy is doing well overall, and even though people are spending a bit less, it’s still at a solid level. Powell also mentioned that the job market is more balanced now, thanks to more workers coming in and higher participation from people aged 25 to 54. The unemployment rate has gone up slightly to 4% but is still quite low historically.

Powell pointed out that while recent inflation data looks promising, he needs to see more good reports before being confident it’s heading towards the Fed’s 2% goal. He noted that although household finances are okay, lower-income households are feeling more pressure. In addition, wage growth is still high but isn’t the main cause of inflation.

Powell also mentioned that the Fed’s policies are meant to slow down the economy to control inflation and that interest rates might not go back to pre-COVID levels anytime soon.

Will Stocks Go Up in 2024?

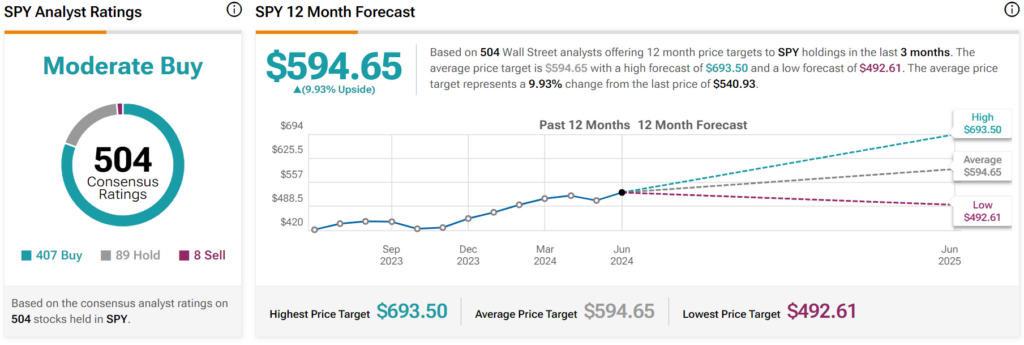

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the SPDR S&P 500 ETF Trust (SPY) based on 407 Buys, 89 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. After a 24% rally in its share price over the past year, the average SPY price target of $594.65 per share implies almost 10% upside potential.