Shares of Fastenal fell over 5% in US morning trading after the industrial supplies company reported lower-than-expected 3Q revenues of $1.41 billion. Analysts on average had expected $1.42 billion. Its 3Q adjusted earnings of $0.38 per share beat the Street consensus by a penny.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Fastenal’s (FAST) net sales rose 2.5% year-over-year primarily due to higher unit sales of safety products. However, its daily sales of fastener products declined 6.9% year-over-year amid continued softness of the manufacturing and construction markets.

Meanwhile, its daily sales of safety products grew 34.4% in 3Q year-over-year. The company also reported a year-over-year decline of 2.3% in daily sales of other products in 3Q. (See FAST stock analysis on TipRanks)

On Sept. 8, Raymond James analyst Sam Darkatsh downgraded the stock to Sell from Hold, given its risk/reward profile.

“Our downgrade does not reflect any current or future deterioration in quality of either the enterprise or management’s execution,” Darkatsch wrote in a note to investors. “At ~5x forward sales, 20+x EV/EBITDA, and a forward FCF yield of only 2.5%, we simply posit that the market is now ascribing an unrealistic growth profile for the company, especially with roughly one-third of its current mix (safety products) growing at unsustainable levels.”

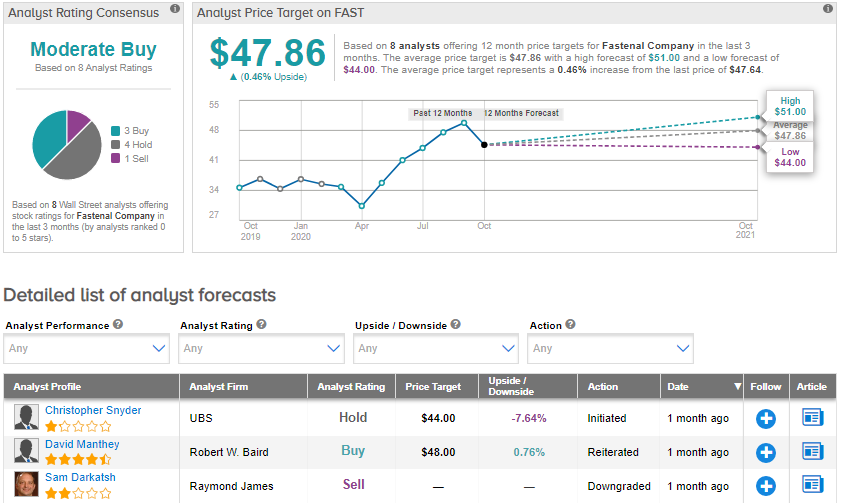

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 3 Buys, 4 Holds and 1 Sell. The average price target of $47.86 implies that shares are fully priced at current levels. Shares have gained 24.9% year-to-date.

Related News:

BlackRock Gains 4% On 3Q Profit Beat; Street Says Buy

New Oriental Rises On Solid Earnings Beat Despite Covid-Headwinds

PerkinElmer Raises 3Q Sales Outlook Fueled By COVID-19 Testing Demand