Online luxury fashion retailer Farfetch Ltd. (NYSE:FTCH) has agreed to acquire a 47.5% stake in rival Richemont’s subsidiary Yoox Net-a-Porter Group (YNAP) in exchange for 12% to 13% of its shares.

YNAP is an Italian online fashion retailer owned by Swiss luxury goods firm Richemont.

As per the terms of the deal, Farfetch has the option to acquire Richemont’s remaining stake in YNAP. Further, Farfetch will give shares worth $250 million to Richemont five years after the completion of the deal, which is expected by the end of 2023.

YNAP and Richemont plan to use Farfetch’s technology to boost future online sales.

Farfetch and Richemont have been in talks for a possible deal over YNAP since last year. In 2020, Richemont pumped $550 million into the U.K.-based company.

After the news was released on Wednesday, shares of Farfetch rose 21.3%. However, the stock lost 0.5% in the extended trading session, ending the day at $9.46.

Is Farfetch a Good Stock to Buy?

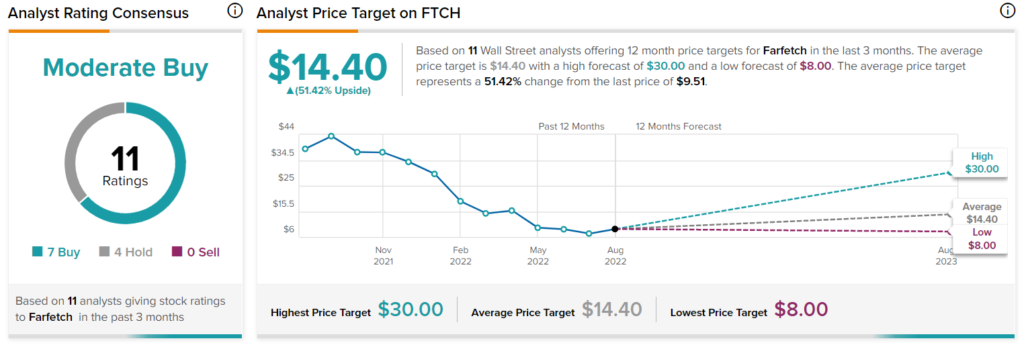

Farfetch has a Moderate Buy consensus rating on TipRanks, which is based on seven Buys and four Holds. FTCH’s average price forecast of $14.40 implies 51.4% upside potential.

Ike Boruchow of Wells Fargo (NYSE:WFC) is one of the seven analysts who has a Buy rating on the stock. The analyst’s price target on FTCH stock stands at $25.

Boruchow believes that the transaction could be transformative for Farfetch as it would solidify the retailer’s top position in the digital luxury space, boost the credibility of its FPS platform, increase gross merchandise value and provide access to Richemont’s Maisons products.

Bloggers are also cautiously optimistic about the stock. TipRanks data shows that financial blogger opinions are 66% Bullish on the stock, compared to the sector average of 65%.

What’s Ahead for Farfetch?

Farfetch is scheduled to release its second-quarter results on August 25, after the market close. The Street anticipates the company to record a loss of 30 cents per share versus a loss of 17 cents in the corresponding quarter last year.

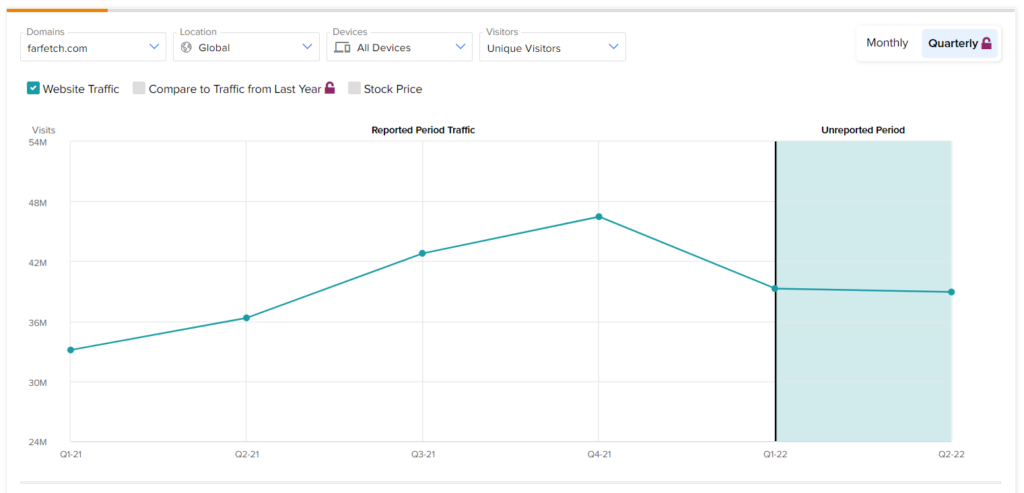

The consensus revenue estimate stands at $566.53 million, up 8.3% year-over-year. The increase is in line with a 6.5% quarter-over-quarter rise in visits to Farfetch’s mobile app in the second quarter. However, the footfall on the company’s website has declined 11.4%, leading to an almost 1% fall in the overall global website traffic, according to TipRanks’ Website Traffic Tool.

Read full Disclosure