The transition to electric vehicles (EVs) has been one of the most significant shifts in the auto industry since Henry Ford introduced the assembly line. In this rapidly evolving landscape, companies are grappling with driving costs down, increasing the driving range of vehicles, and adding more opportunities for buyer personalization. Faraday Future (FFIE) plans to turn things around and launch two new EV models, the FX 5 and FX 6, in this growing and ever-competitive industry.

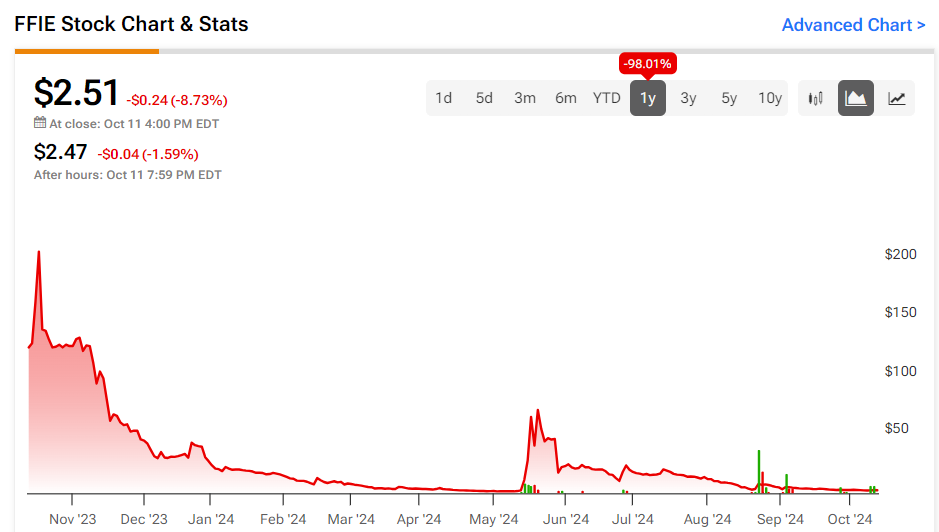

These cars will have AI-powered smart cabins and extended-range options. The company aims to offer these vehicles at a lower cost for the mainstream market while providing luxury options. Touted as ‘Co-create Your AIEV,’ the brand seeks to leverage a user-driven approach to vehicle creation to drive sales. However, the situation is not without a fair amount of risk. The stock is down 98% over the past year, and the company has been heavily reliant on funding from Sheikh Abdulla Al Qassimi from the UAE.

Investors may want to hold off and watch for signs of a successful launch of the new models before entertaining establishing a position.

Faraday Looks to Differentiate Itself

Faraday Future specializes in the design, development, manufacturing, engineering, sales, and distribution of electric vehicles and associated products. It drives sales through an online direct sales ecosystem for user acquisition and management.

The company has announced plans to release two FX models – the FX 5 and FX 6. These models are targeted to the mainstream and luxury markets, respectively, with prices ranging from $20,000 to $50,000. Given adequate funding, Faraday intends to have the first vehicle rolling off the assembly line by the end of 2025.

In a unique twist, the company invites users to participate in the lifecycle of Faraday X products and co-create a product. The AIEV mass market remains largely untapped, providing the company an opportunity to differentiate itself and penetrate the market.

Faraday’s Recent Financial Results

The company’s financial performance has improved over recent periods. Operating expenses dropped from $49.4 million in Q2 2023 to $29.9 million in the latest quarter, and operational losses also reduced from $56.0 million to $50.6 million in the same period. Furthermore, the cash outflow from operations saw a notable decrease in the six months ending June 30, 2024, falling from $160.7 million to a significantly lower $29.1 million.

Faraday has announced its acceptance of a 10% share in Grow Fandor, a global IP commercialization company, from YT Jia, Faraday Future’s Founder and Chief Product User Ecosystem Officer. The shares were part of Jia’s stake in Grow Fandor, amounting to approximately 60% of his holdings. Both companies are exploring potential collaborations to capitalize on their respective strengths.

Is Faraday Future a Buy?

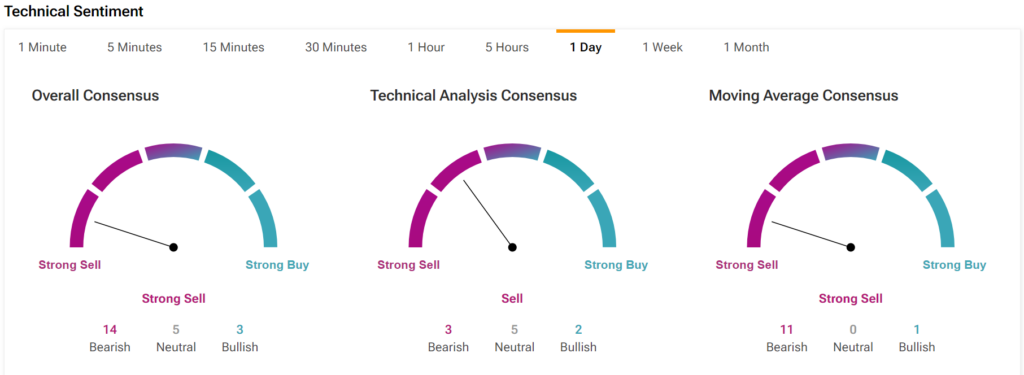

The stock is extremely volatile. It has dropped roughly 37% in the past month. It trades at the bottom of its 52-week price range of $1.55 – $210.00, showing ongoing negative price momentum. It is trading below its 20-day (3.16) and 50-day (5.72) moving averages. Investors may want to hold off for now and look for a shift to more sustained positive price momentum before considering the stock.

Final Thoughts on FFIE

As the auto industry shifts towards electric vehicles (EVs), Faraday Future is trying to position itself to participate in the revolution. Its AI-enabled auto designs and affordable options could be a game-changer if the company can survive and secure the necessary funding to hit its 2025 launch target. However, the company’s recent financial struggles and a volatile stock price are causing investors to proceed cautiously and look for more positive results before considering Faraday Future as a viable investment.