Shares of the social media giant Facebook, Inc. (FB) dropped 3.5% in Wednesday’s extended trading session despite a strong second-quarter earnings beat after the company cautioned that revenue growth is expected to decelerate in the coming quarters.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Notably, the company delivered blowout Q2 results, topping both earnings and revenue estimates. Shares of the company have jumped 60% over the past year. (See FB stock charts on TipRanks)

Earnings of $3.61 per share doubled year-over-year and beat analysts’ expectations of $3.02 per share. The company reported earnings of $1.80 per share in the prior-year period.

Furthermore, revenues jumped 56% year-over-year to $29.1 billion and exceeded consensus estimates of $27.82 billion. The increase in revenues reflected a surge in advertising revenues, which increased 56% to $28.6 billion.

The company said that advertising revenue growth was attributable to a 47% year-over-year jump in the average price per ad and 6% growth in the number of ads delivered.

Daily active users (DAUs) grew 7% year-over-year to 1.91 billion, whereas monthly active people (MAP) grew 12% to 3.51 billion.

Operating margin increased 1,100 bps to 43% versus 32% reported in the prior-year quarter.

Looking ahead, Facebook provided updates about the third and fourth quarters of 2021. “We expect year-over-year total revenue growth rates to decelerate significantly on a sequential basis as we lap periods of increasingly strong growth. When viewing growth on a two-year basis to exclude the impacts from lapping the COVID-19 recovery, we expect year-over-two-year total revenue growth to decelerate modestly in the second half of 2021 compared to the second-quarter growth rate.”

Facebook added, “We continue to expect increased ad targeting headwinds in 2021 from regulatory and platform changes, notably the recent iOS updates, which we expect to have a greater impact in the third quarter compared to the second quarter. This is factored into our outlook.”

Facebook founder and CEO, Mark Zuckerberg, commented, “I’m excited to see our major initiatives around creators and community, commerce, and building the next computing platform coming together to start to bring the vision of the metaverse to life.”

Facebook will keep a close watch on developments concerning the feasibility of transatlantic data transfers and their possible impact on the company’s European operations.

Following the upbeat Q2 results, Morgan Stanley analyst Brian Nowak increased the price target on Facebook from $375 to $400 (7.2% upside potential) and reiterated a Buy rating.

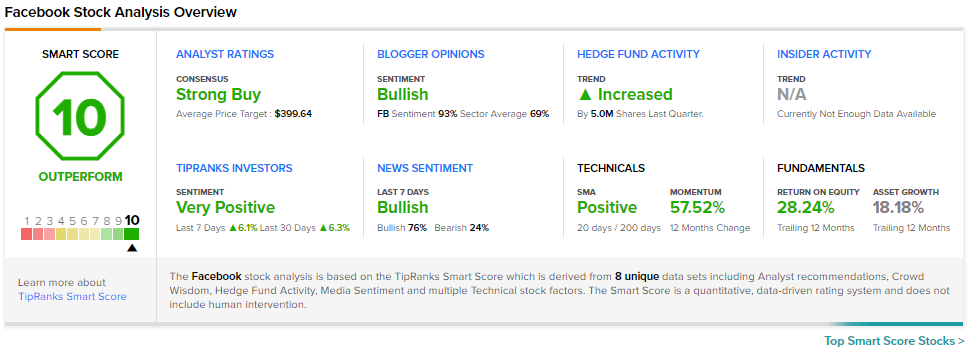

Consensus among analysts is a Strong Buy based on 13 Buys, 1 Hold, and 1 Sell. The average Facebook analyst price target of $398.75 implies 6.8% upside potential to current levels.

FB scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Alphabet Reports a Blowout Quarter, Ad Revenues Outperform

Teladoc Down 7.4% on Earnings Miss, Raises Guidance

Matador Resources Reports Quarterly Beat; Shares Surge 5%