Facebook Inc. (FB) and PayPal Holdings (PYPL) are investing in Indonesian payment, food delivery and ride-hailing app operator Gojek. The size of the investment wasn’t disclosed.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The investment is made as part of Gojek’s current fundraising round. Alphabet Inc’s Google (GOOGL) and Tencent are also among the list of investors.

Since launching its app in 2015, Gojek has brought hundreds of thousands of merchants onto its platform, giving them access to more than 170 million people across Southeast Asia. Its payments business processes billions of transactions each year and owns the largest e-wallet in Indonesia.

Facebook said Gojek is Indonesia’s first and fastest growing app for ordering food, shopping, commuting, and making digital payments across Southeast Asia. With this investment the social media operator seeks to “support the growth of millions of small businesses”.

The investment is the first it has made in an Indonesia-based business as it wants to have a foothold in the country, including through its Whatsapp service. Just over a month ago, the social media giant announced a $5.7 billion investment for 9.99% of Jio Platforms Ltd., an Indian telecommunications company.

Gojek said the new investment will help its target to boost Southeast Asia’s digital economy, with a focus on payments and financial services in the region.

As part of a commercial agreement, PayPal’s payment tools will be integrated into Gojek’s services and the two companies will also collaborate to allow customers of GoPay, Gojek’s digital wallet, to gain access to PayPal’s network of more than 25 million merchants around the world.

“Southeast Asia is at an inflection point in digital adoption that creates new opportunities to deliver financial services to previously unbanked merchants and consumers,” PayPal’s Farhad Maleki said in a statement.

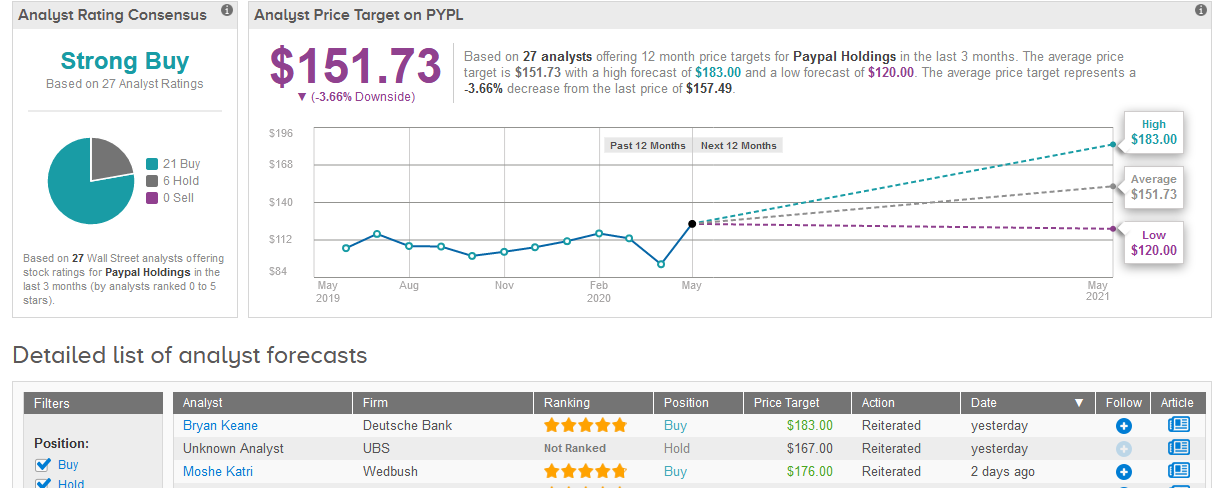

Five-star analyst Bryan Keane at Deutsche Bank yesterday raised PayPal’s price target to $183 (16% upside potential) from $147 and reiterated a Buy rating on the stock, amid expectations that the company will sustain elevated payment volume growth rates above its medium term guidance driven by higher e-commerce user adoption.

Keane adds that business improved further into early May and he believes that PayPal likely hasn’t seen any material change in “strong” growth rates as global economies are starting to gradually reopen.

The Wall Street analyst community has a bullish outlook on the stock. The Strong Buy consensus is backed up by 21 Buy versus 6 Hold ratings. The $151.73 average price target set by analysts forecasts 3.7% downside potential after shares almost doubled since March. (See PayPal stock analysis on TipRanks).

Related News:

Google Mulling Purchase of Stake in Indian Vodafone Idea

Google Faces Arizona Lawsuit Over ‘Unfair’ Location Data Storing

Microsoft Seeks $2B Stake In India’s Jio Platforms- Report