Shares of F5 Networks rose 4.3% in Monday’s extended trading session after the cloud-based security service provider’s 1Q outlook topped its guidance following better-than-expected 4Q results.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

F5 Networks (FFIV) projects 1Q revenues of between $595 million and $615 million, surpassing Street estimates of $592.8 million. The mid-point of the adjusted EPS guidance range of $2.26-$2.38 is also way above Wall Street’s projection of $2.28.

For the fourth quarter, F5 Networks reported adjusted EPS of $2.43 that exceeded analysts’ expectations of $2.37 as well as the company’s own guidance range of $2.30-$2.42. (See FFIV stock analysis on TipRanks).

F5 Networks’ 4Q sales of $615 million beat Street estimates of $606.3 million and matched the high-end of its $595-$615 million guidance range. The IT security provider’s quarterly revenues increased 4% year-over-year driven by 36% growth in software revenues.

F5 Networks CEO François Locoh-Donou said, “Going forward, we expect continued robust software growth from a more diversified base of subscription and SaaS revenue, a software subscription renewals flywheel that is starting to turn with momentum, and true-forward revenue opportunities on a significant percentage of our long-term software subscription contracts.”

On Oct. 13, Morgan Stanley analyst James Faucette reiterated a Buy rating on the stock saying that F5 Networks would benefit from increased spending on application delivery controllers (ADC). Citing a CIO (Chief Information Officer) survey, Faucette noted that spending of ADC is expected to increase by 29%, significantly higher than the 16% growth forecasted in the last survey.

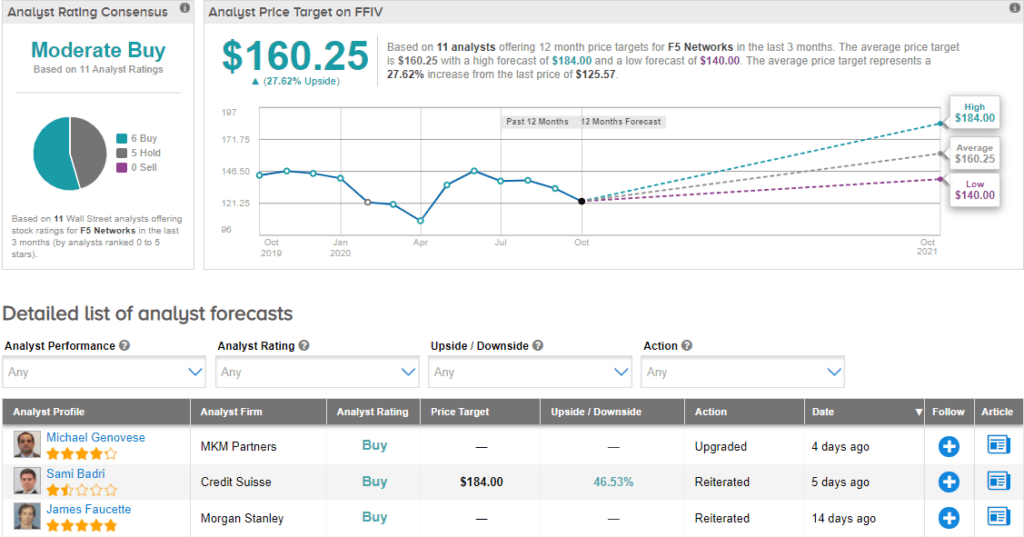

Currently, the Street is cautiously optimistic on the stock. The Moderate Buy analyst consensus is based on 6 Buys and 5 Holds. With shares down over 10% year-to-date, the average price target of $160.25 implies upside potential of about 27.6% to current levels.

Related News:

Barnes’ 3Q Profit Drops 66%, Sees Lower 4Q Sales

Seagate’s 1Q Sales Miss; Analyst Raises PT

SAP Slashes 2020 Guidance As Covid-19 Surge Slows Recovery