A slump in oil prices appears to have significantly impacted Exxon Mobil’s (XOM) third-quarter upstream earnings, potentially reducing profits by $600 million to $1 billion, according to the oil major’s regulatory filing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

XOM’s Q3 Earnings Could Be Impacted by a Fall in Oil Prices

During the third quarter, oil prices dropped by 17%, marking the largest quarterly decline in a year. The fall in oil prices was driven by concerns over the global outlook for oil demand. Additionally, weaker refining margins during the quarter could further impact XOM’s profits by as much as $1 billion. This downward pressure on refining margins stems from softer consumer and industrial demand in global fuel markets, particularly in China, where a slowdown in economic growth and increased electric vehicle usage have contributed to lower fuel consumption.

XOM’s Q3 Results Could Have a Silver Lining

While lower oil prices and shrinking refining margins are expected to weigh heavily on Exxon’s performance, these effects will be partly offset by other factors. Specifically, gains of around $900 million from timing effects will provide some financial relief, along with a reduction in scheduled maintenance at the company’s refineries. Timing effects refer to the mark-to-market impact of derivative trading.

The reduction in maintenance means fewer disruptions to oil production, which could boost the company’s third-quarter results. XOM is expected to announce its Q3 results on November 1.

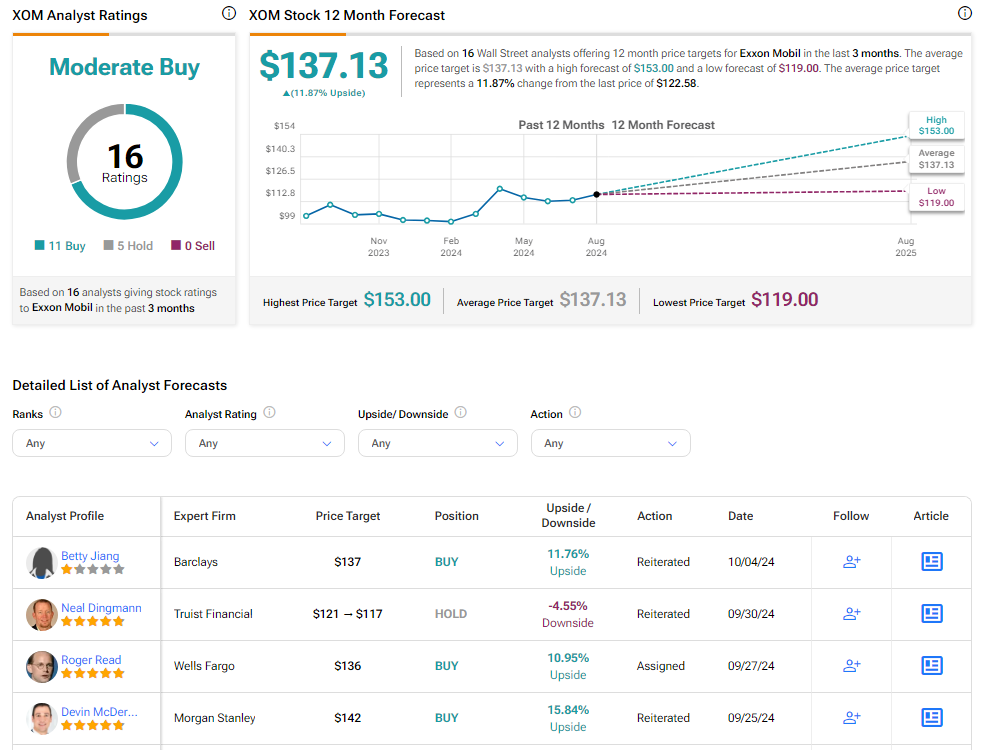

Is Exxon a Buy, Sell, or Hold?

Analysts remain cautiously optimistic about XOM stock, with a Moderate Buy consensus rating based on 11 Buys and five Holds. Over the past year, XOM has increased by more than 10%, and the average XOM price target of $137.13 implies an upside potential of 11.8% from current levels.