With an aim to reduce operating costs and improve shareholder returns, Exxon Mobil Corporation (NYSE: XOM) has announced a business reorganization plan. The global oil and gas corporation is on track to achieve over $6 billion in structural cost savings by 2023.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Reorganization Plan

ExxonMobil plans to move its corporate headquarters from Irving, Texas, to its campus north of Houston by mid-2023.

Effective April 1, as part of the reorganization, three business lines, including an oil-and-gas production unit named ExxonMobil Upstream Company, a chemicals-and-refining unit named ExxonMobil Product Solutions, and a low-carbon unit named ExxonMobil Low Carbon Solutions, will be formed.

Remarkably, no impact on the soon-to-be-reported fourth-quarter earnings is expected due to the streamlining process.

CEO’s Comments

The CEO of ExxonMobil, Darren Woods, said, “Our transformed business structure enables us to more fully leverage the corporation’s scale, integration, technology advantages, and the skills and capabilities of our talented workforce, to better serve our customers.”

“Aligning our businesses along market-focused value chains and centralizing service delivery, provides the flexibility to ensure our most capable resources are applied to the highest corporate priorities and positions us to deliver greater shareholder returns,” Woods added.

Wall Street’s Take

Recently, UBS analyst Jon Rigby maintained a Hold rating on the stock but increased the price target to $77 (1.37% upside potential) from $68.

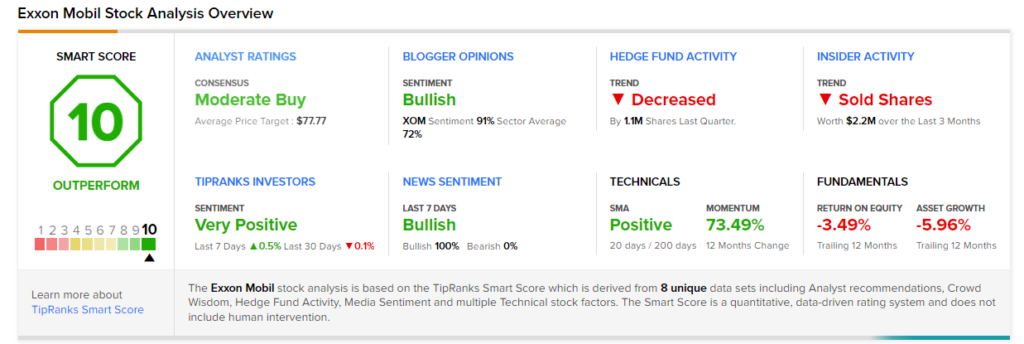

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 6 Buys and 7 Holds. The average ExxonMobil price target of $77.77 implies 2.38% upside potential from current levels. Shares have gained 23.7% over the past six months.

ExxonMobil is expected to release its upcoming earnings report for the fourth quarter of 2021 on February 1.

Smart Score

ExxonMobil scores a “Perfect 10” from TipRanks’ Smart Score rating system. This makes it one of TipRanks’ Top Stocks and implies that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Bristol Myers Squibb Gets Positive CHMP Opinion for Breyanzi; Shares Gain

Chevron’s Q4 Earnings Miss Expectations; Shares Drop Over 3%

AstraZeneca Summoned by Chinese Regulators over Suspected Medical Insurance Fraud