Exxon Mobil (XOM) shares were soaring 4% higher in the early trading session today after the biggest U.S. oil giant posted the highest profit ever recorded in its history in any given quarter.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The stellar second-quarter results were driven by sky-high oil prices, higher production, realizations, and margins, as well as tightened cost control initiatives.

XOM’s Stellar Q2 Beat

The company reported stellar quarterly earnings of $4.14 per share, significantly higher than analysts’ estimates of $3.89 per share.

Notably, EPS almost quadrupled compared to the $1.14 per share reported in the prior-year period.

To add to that, revenue climbed a whopping 70.8% to $115.68 billion compared to the prior-year period and easily outpaced the Street’s estimate of $111.67 billion.

XOM CEO’s Comments

XOM CEO Darren Woods commented, “Key to our success is continued investment in our advantaged portfolio, including Guyana, the Permian, global LNG, and in our high-value performance products, along with efforts to reduce structural costs and improve efficiency.”

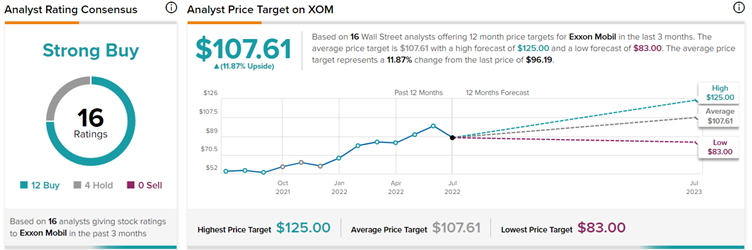

Wall Street’s Take on XOM

Wall Street analysts are bullish on the stock, with a Strong Buy consensus rating based on 12 Buys and four Holds. The average Exxon Mobil price target of $107.61 implies an upside potential of 11.87% at current levels.

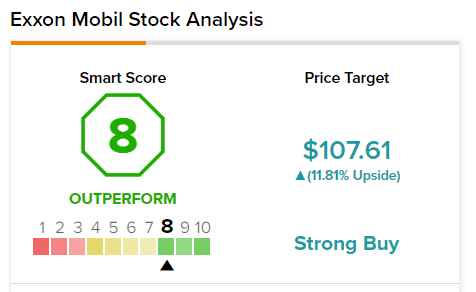

High TipRanks Smart Score for XOM

XOM scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Concluding Thoughts

Globally, oil producers are posting record margins and profitability on the back of surging oil and natural gas prices, further triggered by the Russia-Ukraine crisis.

Making the most of the upsurge in demand, the company announced an expansion of its refining capacity by about 250,000 barrels per day in the first quarter of 2023.

The further capacity expansion combined with sustainable demand and increased pricing bodes well for the stock in the coming months.