Oil giant Exxon Mobil (NYSE:XOM) has now completely pulled out of Russia after failed attempts to orderly transfer or sell its 30% stake in the Sakhalin-1 oil and gas project. As per Reuters, the oil giant stated that the Russian government expropriated its assets and “unilaterally terminated” its interests in the Sakhalin-1 project.

Reuters further added that the company did not specify if it received any compensation for its stake in the project, which it had valued at more than $4 billion. The manner in which Exxon is exiting its Russian operations indicates that there could be multi-year legal disputes between the company and the Russian government.

As per a statement cited by CBS News, Exxon’s spokeswoman stated, “With two decrees, the Russian government has unilaterally terminated our interests in Sakhalin-1, and the project has been transferred to a Russian operator.”

Amid Russia’s invasion of Ukraine, Exxon announced in March its decision to discontinue operations at Sakhalin-1 and make no new investments in Russia. Back then, the company had intended to exit its project in the country in an orderly fashion by coordinating with its Russian, Indian, and Japanese partners.

Exxon recorded post-tax charges of $3.4 billion in the first quarter to reflect the impairment of its Sakhalin-1 operations. In its recent Q3 update, the company mentioned an impairment charge of $0.6 billion but didn’t specify if it was related to Russian assets.

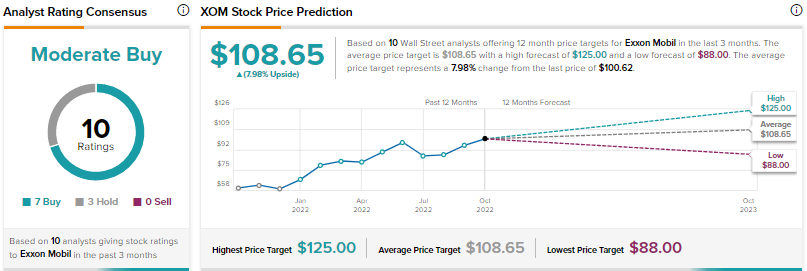

What is the Target Price for Exxon Stock?

Exxon stock has rallied 64.5% this year amid rising oil and gas prices due to supply constraints resulting from the Russia-Ukraine conflict.

Currently, Wall Street analysts are cautiously optimistic about Exxon stock with a Moderate Buy consensus rating based on seven Buys and three Holds. The average XOM stock price target of $108.65 implies nearly 8% upside potential from current levels.