Online travel shopping company Expedia Group, Inc. (EXPE) has reported better-than-expected results for the third quarter ended September 30, 2021. The robust results can be attributed to the growth witnessed in revenues.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the earnings, shares of the company appreciated 15.6% to close at $182.17 on Friday.

Revenue & Earnings

Quarterly revenues jumped 97% year-over-year to $2.96 billion and surpassed the consensus estimate of $2.76 billion. The primary drivers of the revenue growth were the Lodging (up 87% year-over-year) and Advertising and Media (up 116% year-over-year) segments, which accounted for 77.7% and 6.8% of the total revenues, respectively.

The company reported quarterly earnings per share (EPS) of $3.53, which compares favorably with the previous year’s loss of $0.22 per share.

Other Operating Metrics

In other operating metrics, while the company’s gross bookings witnessed a year-over-year rise of 117% to $18.73 billion, adjusted EBITDA of $855 million grew 181% from the same quarter last year.

Management Commentary

The CEO of Expedia Group, Peter Kern, said, “Despite continued volatility in the travel recovery, Expedia Group’s net income and adjusted EBITDA for the quarter nearly matched our Q3 2019 levels driven by the superior performance from Vrbo and domestic travel along with improvements across virtually all lines of business. With early positive signs in Q4 and many countries announcing new openings to international travelers, we are feeling increasingly confident about a continued recovery.”

See Analysts’ Top Stocks on TipRanks >>

Price Target

Following the earnings, Barclays analyst Mario Lu reiterated a Buy rating on the stock. The analyst, however, raised the price target to $210 from $180, which implies upside potential of 15.3% from current levels.

In a research note to investors, the analyst said, “Trends in October significantly improved to down 2% versus 2019 with broad-based improvements seen throughout the quarter, suggesting there is a possibility that Q4 lodging bookings for Expedia may actually turn to positive growth when compared to 2019.”

The Wall Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 6 Buys and 8 Holds. The average Expedia price target of $189.46 implies that the stock has upside potential of 4% from current levels. Shares have gained about 41.6% over the past year.

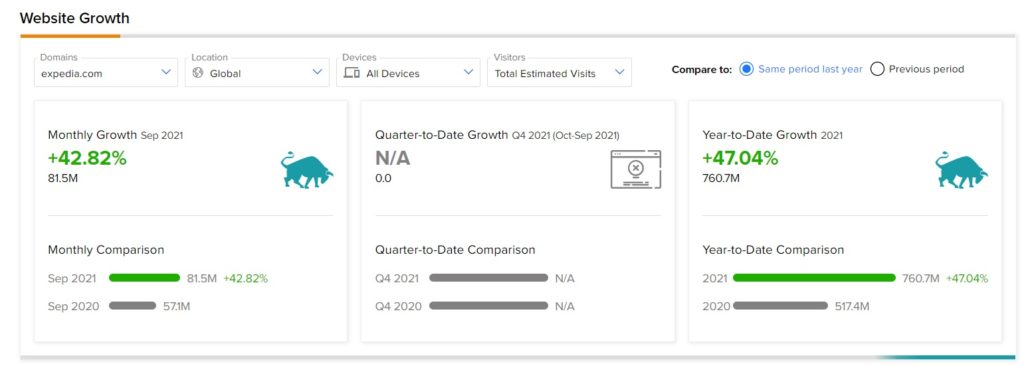

TipRanks Website Traffic

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Expedia’s performance this quarter. According to the tool, the Expedia website recorded a 42.82% monthly rise in global visits in September. Further, year-to-date, website traffic fell 47.04%.

Related News:

Square’s Q3 Results Miss the Mark

Uber Posts Mixed Q3 Results; Shares Dip

Pinterest Post Stellar Q3 Results