Shares of Expedia (EXPE) fell over 5% in pre-market as travel restrictions took a toll on operations in the second quarter. The company lost $4.09 per share in 2Q, significantly worse than analysts’ expectations of a $3.34 loss. Moreover, it compared unfavorably to the earnings of $1.77 per share in the year-ago period.

Expedia’s quarterly revenues plunged 82% to $566 million year-over-year and missed the Street estimates of $681.9 million. The significant drop in its revenues reflects a decline in bookings due to travel restrictions imposed by countries across the world to contain coronavirus. Bookings fell by 90% year-over-year during the quarter.

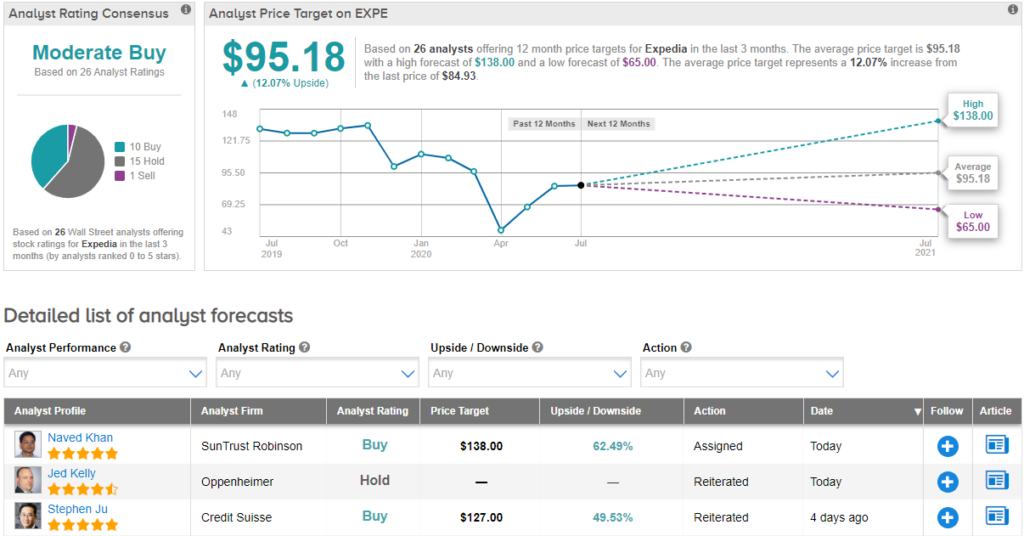

Despite a weak 2Q, five-star analyst Naved Khan of SunTrust Robinson assigned a Buy rating on Expedia with a price target of $138 (62.5% upside potential).

In a research note, Khan said, “We’re encouraged by signs of a strong recovery in core lodging, which saw a rebound in net bookings during May/June and stabilized trends in July.” He further stated, “We expect these changes to result in a more nimble and profitable business over the M/L term, supporting our bullish LT view.”

Overall, EXPE has a Moderate Buy analyst consensus. Given over 21% year-to-date decline in its stock, the average price target of $95.18 implies a 12.1% upside potential in the coming 12 months. (See EXPE stock analysis on TipRanks).

Related News:

Apple Up 6% After-Hours On Blowout Quarter; Strong iPhone Demand

Amazon Rises 5% As ‘King Of E-Commerce Shines Amidst The Pandemic’

Facebook Soars 6% After-Hours On Strong Beat, Ad Resilience