Expedia (NASDAQ:EXPE) shares plunged by over 10% in the early trading session today after the online travel solutions provider’s slashed financial outlook overshadowed its first-quarter revenue growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, Expedia’s revenue increased by 8.2% year-over-year to $2.89 billion. The figure fared better than estimates by roughly $90 million. Its EPS stood at $0.21, with adjusted EBITDA rising by 38% to $255 million.

VRBO Weighs on Expedia

While the quarter was marked by strength in Brand Expedia, Advertising, and its B2B channels, the company saw weak momentum in gross bookings with a growth of 3%. Additionally, Expedia is experiencing a slower-than-anticipated recovery in the VRBO vacation rentals brand following its re-platforming (Expedia has migrated the VRBO brand to its overarching Expedia platform).

However, Expedia’s booked room nights improved to 101.2 million from 77.4 million in Q4. Similarly, its booked air tickets increased to 14.2 million from 11.4 million in the prior quarter.

Despite this uptick, Peter Kern, the Vice Chairman and CEO of Expedia, expects the performance of the VRBO brand to weigh on the company’s financials. Consequently, Expedia has lowered its revenue outlook for the full year to a mid-to-high single-digit growth from the prior 10% estimate. The company expects its margins to stay in line with its last year’s performance.

What Is the Target Price for EXPE?

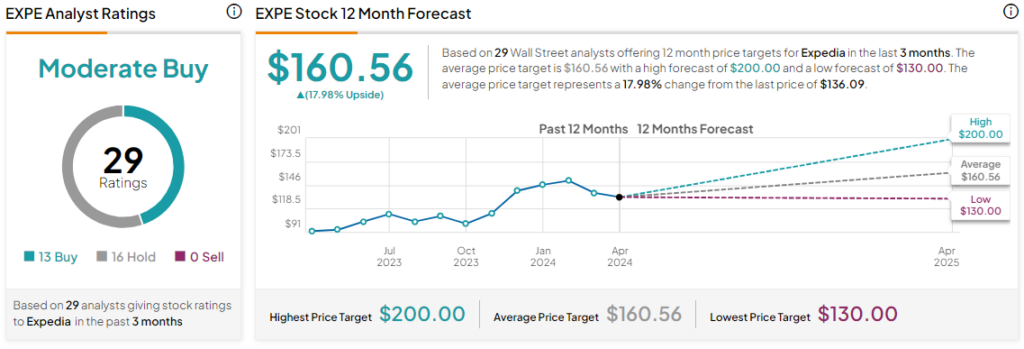

Today’s price decline further adds to the nearly 10% drop in Expedia’s share price so far this year. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average EXPE price target of $160.56.

Read full Disclosure