So, we’ve known about the layoffs coming to chipmaker Intel (INTC) for some time now, but what we didn’t really have were exact numbers on how many of Intel’s staffers would be shown the door. Those numbers have emerged, and with them, a distressing pronouncement about Intel’s potential long-term health. The news sent Intel into a death spiral, down nearly 27% in Friday afternoon’s trading.

The latest numbers say that Intel will be letting go of “at least 15,000 employees,” contributing to one of the worst years for tech sector layoffs in recent memory. Reports note that the numbers may ultimately go as high as 19,000 as Intel works to bring in $10 billion in net cost savings for 2025.

How it plans to reach that point, meanwhile, will likely have all employees concerned. Marketing spending is up for substantial reductions, as is research spending, which is a dark sign in and of itself. But Intel also plans to stop “non-essential work,” though it wouldn’t elaborate on what qualifies as “non-essential work.” Or, of course, why it was ever doing “non-essential work” in the first place. With Intel chips falling out of favor for various competitors’ options and a status as an AI laggard, that adds up to little good for Intel.

“Existential Crisis”

When the words “existential crisis” come up, it’s no surprise to see some worrying. After all, Intel is firing huge clusters of employees, paring back its research and development, and carrying out other tasks that suggest a death spiral is already in progress. It even suspended its dividend, a sign that Intel needs cash right now and badly enough to risk running off fixed-income investors.

However, there’s a point to consider: some believed that Intel was having an existential crisis back in 2020, when its status as a chip manufacturer was being questioned. Intel’s been working on that one ever since, with numerous moves toward filling foundry aspirations. If one existential crisis didn’t kill Intel four years ago, it’s a good bet that this one won’t do it, either.

What Is the Future Price of Intel Stock?

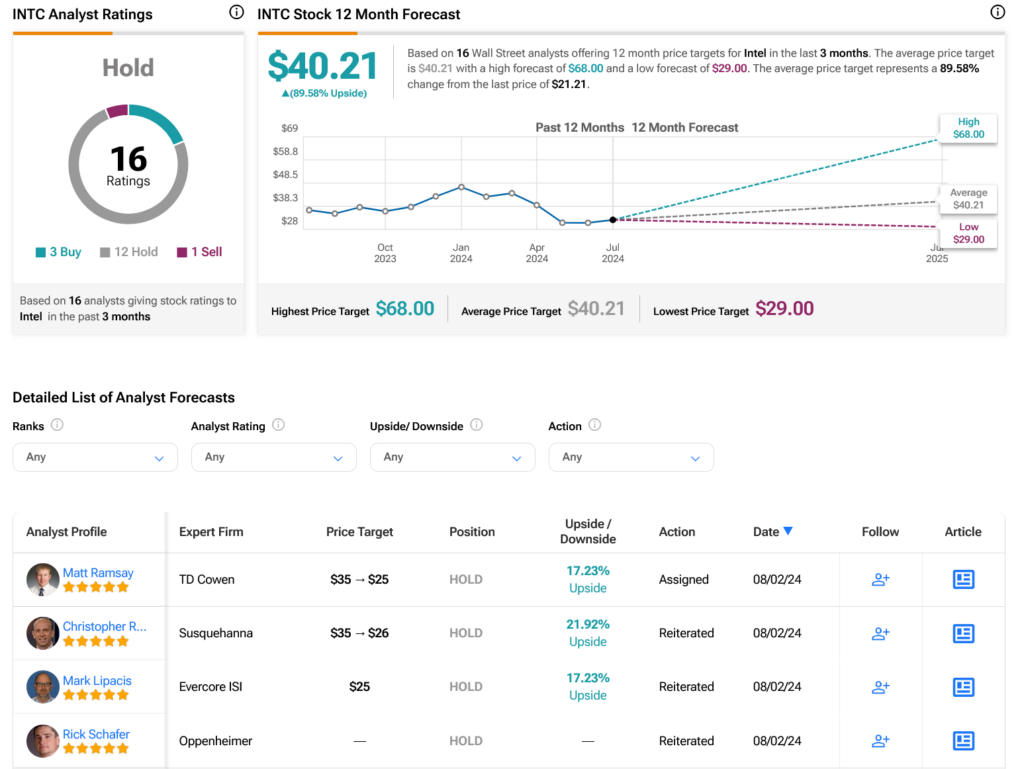

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on three Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 37.99% loss in its share price over the past year, the average INTC price target of $40.21 per share implies 89.58% upside potential.