Shares of Evercore Partners gained about 6% on Wednesday after the investment banking company’s 3Q EPS of $1.11 outpaced analysts’ estimates of $0.38. The company also announced a dividend hike of 5.2%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Evercore’s (EVR) revenues remained flat at $408.5 but exceeded the Street consensus of $320.5 million. The company said that higher underwriting revenues were offset by a decline in advisory fees, commissions and related fees.

Evercore announced a quarterly dividend to $0.61 per share, up from $0.58 previously. The dividend will be paid on Dec. 11 to stockholders of record on Nov. 27. The annualized dividend of $2.44 per share, reflects a yield of 3.1%. . (See EVR stock analysis on TipRanks).

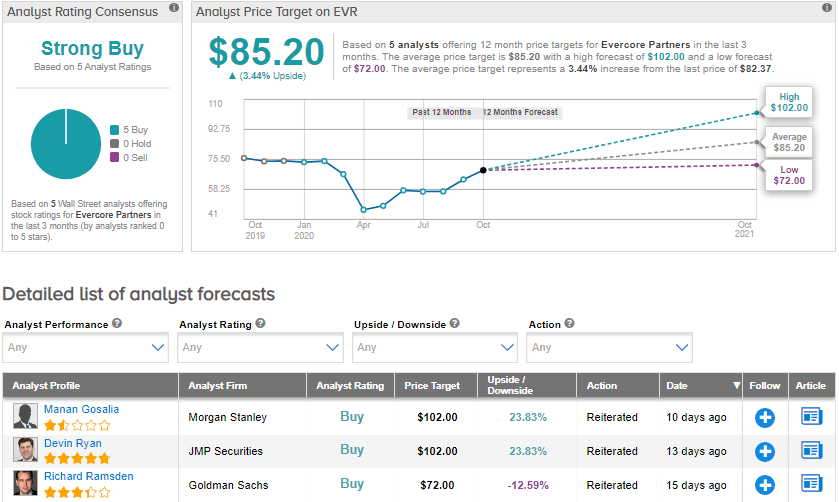

On Oct. 9, JMP Securities analyst Devin Ryan raised the stock’s price target stock to $102 (23.8% upside potential) from $83 and maintained a Buy rating. The 5-star analyst said continued recovery in the capital markets in the past few months should provide “attractive opportunities” for the company to deliver organic growth over the next 1-2 years.

Currently, the Street is bullish on the stock. The Strong Buy analyst consensus is based on 5 Buys. The average price target of $85.20 implies upside potential of about 3.4% to current levels. Shares have gained by 10.2% year-to-date.

Related News:

KeyCorp’s Profit Rises As Credit Loss Provisions Drop 20%

Pentair Raises 2020 Outlook As Pool Sales Rise; Shares Gain 4%

Albertsons Jumps 5.6% As Online Sales Pop 243%