AMC Entertainment (AMC) has been grappling with significant financial issues due to low attendance rates, worker strikes, and fewer major film releases. Despite some recent box office successes (looking at you, Deadpool), overall revenue, attendance, and profitability are declining. The company’s recent agreement with creditors to reduce debt and extend maturities to 2029 helps strengthen its balance sheet while potentially resulting in dilution.

On a positive note, a policy shift from the Federal Reserve may lighten AMC’s debt burden in the short to medium term. However, with substantial debt, cash flow problems, and shareholder dilution, the investment outlook for AMC remains unfavorable. Investors should continue to approach with caution.

AMC’s Meme Craze Fizzling Out

AMC is a global leader in the movie exhibition industry, with approximately 900 theaters and 10,000 screens worldwide. It provides diverse content, including the most recent Hollywood releases and independent programming.

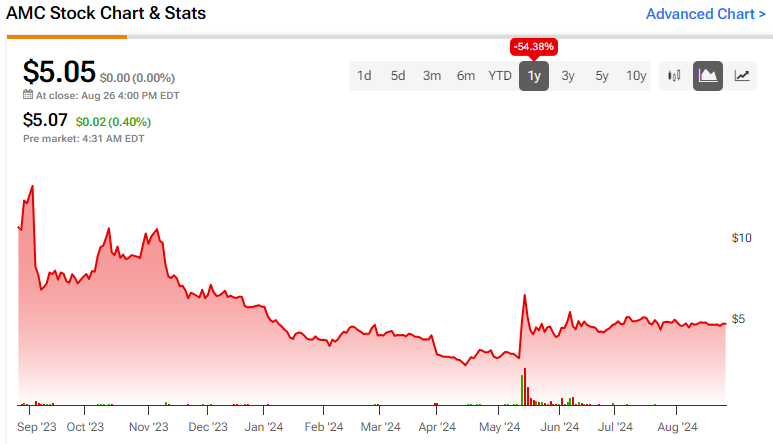

The company became a favorite among the online investor community (aka “Apes”) during the meme craze that saw an astronomical rise of over 2,800% in its stock value from the close of 2020 to June 2021. However, this was followed by a steep decline, with the stock falling by 97% since. Despite this, a large number of these retail investors have held onto their shares, hoping for a major short squeeze scenario, often referred to as the “MOASS” (mother of all short squeezes), to drive the stock price back to its former heights.

In a recent and unexpected development, AMC shares saw a notable surge of over 100% within a few days at the beginning of May, a spike seemingly spurred by renewed interest in the resurgence of the meme-stock frenzy. Shares have since declined over 26% and are down 17% year-to-date overall.

Analysis of AMC’s Recent Financial Results

The second quarter of 2024 saw a decline in several key financial results compared to the same period in 2023. Total revenues decreased to $1,030.6 million from $1,347.9 million, marking a 23.5% drop. There was a net loss of $32.8 million compared to net earnings of $8.6 million in Q2 2023. Furthermore, the net loss per diluted share was -$0.10 compared to net earnings of $0.06 per diluted share in Q2 2023. Adjusted EBITDA also took a hit, coming in at $29.4 million compared to $182.5 million in the previous year. Q2 Non-GAAP earnings per share (EPS) of -$0.43 missed analysts’ expectations by $0.33.

Net cash used in operating activities rose to $34.6 million from $13.4 million in Q2 2023. However, cash and cash equivalents at the quarter’s close were significant at $770.3 million.

AMC announced a series of refinancing initiatives to extend the maturity of approximately $1.6 billion in debt from 2026 to 2029 and 2030. The company plans to repurchase $800 million of existing Senior Secured Term Loans due in 2026 and replace them with new ones set to mature in 2029. AMC has issued $414 million in new 6.00%/8.00% Cash/PIK Toggle Senior Secured Exchangeable Notes due in 2030, with plans to potentially issue an extra $50 million to buy back additional outstanding debt due in 2025, 2026, and 2027.

What Is the Price Target for AMC Stock?

The stock has been on a volatile downward trajectory, posting a beta of 2.29 as it has shed 54% in the past year. Shares trade toward the bottom of the 52-week price range of $2.38 – $13.90, though they show positive price momentum by recently trading above the 20-day (5.04) and 50-day (4.96) moving averages.

Analysts following the company have taken a cautious stance on AMC stock. For example, Morgan Stanley (MS) recently lowered the price target on the shares from $11 to $10 while maintaining an Underweight rating, noting that it expects another year of double-digit earnings declines in 2025.

AMC Entertainment is rated a Moderate Sell based on six analysts’ recommendations and price targets. The average price target for AMC stock is $4.80, representing a potential -4.95% downside from current levels.

Final Analysis on AMC

Despite AMC’s standing as a global heavyweight in the movie exhibition industry, financial adversities have hit it hard. While there’s been a remarkable surge in its stock value induced by the meme craze, consistent revenue decline and weakened profitability pose additional risks. Furthermore, its efforts to strengthen the balance sheet through debt reduction and extending maturities might lead to potential dilution for investors. Consequently, investors should tread carefully.