Hong Kong-listed EV titans BYD Co. Limited (HK:1211) and its rival XPeng (HK:9868) are celebrating their record sales in October. Last month’s sales were fueled by strong domestic demand despite the challenges in international expansion due to the EU (European Union) tariffs. As of writing, BYD shares rose nearly 4%, while XPeng stock surged over 8%.

BYD and Rivals Post Solid October Numbers

BYD achieved record sales of 502,757 pure-electric and hybrid EVs in October, marking the first time the company sold over half a million vehicles in a month. October sales reflected a 66.5% year-on-year increase and a 19.8% rise compared to September. This brings the year-to-date sales of BYD’s electric cars to 3,236,927, indicating a 36% increase compared to the same period last year. This was the fifth consecutive month of record sales for BYD.

Meanwhile, BYD’s competitor XPeng delivered 23,917 EVs to mainland customers in October. This marked a new sales record for the second consecutive month, with a 12% increase over September deliveries.

On the flip side, BYD’s other Chinese rival Li Auto (HK:2015) delivered 51,443 vehicles in October, reflecting a 4.2% decrease from the previous month. However, Li Auto’s deliveries increased 27.3% on a year-over-year basis.

Is BYD a Good Stock to Buy?

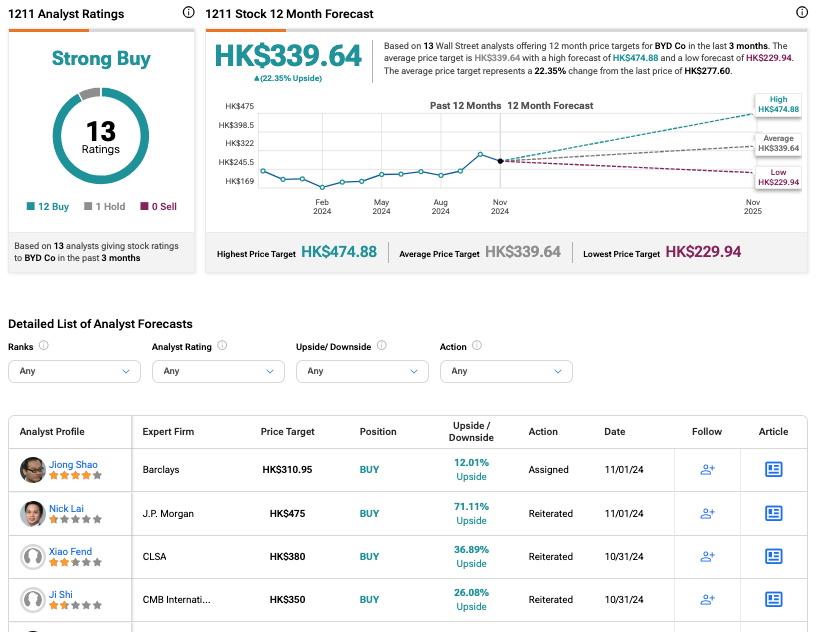

Analysts maintain a highly bullish stance on BYD stock. Following the release of October sales, Barclays and J.P. Morgan confirmed their Buy ratings on the stock. J.P. Morgan analyst Nick Lai predicts an upside of over 70% in the share price, while analyst Jiong Shao from Barclays expects a 12% growth in the share price.

Overall, 1211 stock has received a Strong Buy rating on TipRanks, backed by 12 Buy recommendations and one Hold rating. The BYD Co. share price target is HK$339.64, which implies an upside of 22.35% from the current trading level.