Recently, there was news that pure-play EV enterprises didn’t want to hear, but it was news that represented a lifeline to legacy automotive manufacturer General Motors (NYSE:GM). Essentially, the government softened its stance on efficiency requirements, thus giving GM stock extended fundamental relevance. Simultaneously, there are more questions now about the push for electrification. I am bullish on General Motors based on its flexibility to handle the currently dynamic auto market.

Great News for GM Stock, Not So Much for EVs

Last week, GM stock and its legacy automotive peers popped higher as the federal government adjusted its stance on fuel economy rules. Specifically, the Department of Energy let off the accelerator on a proposal that would have forced auto manufacturers to limit the production of high-gasoline-consumption vehicles. Otherwise, fines of billions of dollars may have been imposed.

However, because of the updated ruling, General Motors and its direct peers can build combustion-powered vehicles through 2030 while still maintaining efficiency standards. To be sure, the government is still pushing for broader electrification. However, the new proposal will allow auto manufacturing firms more time to adjust to green-friendly protocols.

Notably, General Motors would have faced $6.5 billion in fines if the original proposal had stood. As a result, stakeholders of GM stock had plenty to cheer about. However, the same could not be said about pure-play EV stocks.

While GM has witnessed a robust double-digit-percentage move since the beginning of the year, names like Tesla (NASDAQ:TSLA) and Rivian Automotive (NASDAQ:RIVN) are seeing the opposite trend play out. Both names are down sharply since the start of January, leading to questions about forward viability.

Certainly, sector giant Tesla didn’t help matters by sparking an industry-wide price war. Obviously, price slashes on popular EV models force the competition to respond; otherwise, they risk losing market share. However, the move also angered customers who bought their vehicles prior to the cuts. Those who are watching from the sidelines will likely wait to see if more discounts materialize.

However, critics can’t point to Tesla alone. There’s a reason why the company slashed prices, and it’s not just about the competition. EV demand has been falling, not just here but abroad. With that being the case, GM stock should benefit from this backdrop.

A Question of Price

When all is said and done, consumers aim to consume at the lowest price possible. That incentive is only heightened during difficult or challenging economic cycles such as the current juncture. Given that combustion-powered cars are still priced considerably lower than their electric-powered counterparts, GM stock is looking swell.

Right now, the company benefits from the best of both worlds. On the combustion front, it has generated significant momentum with its eighth-generation Corvette. Offering a sports car with a big, bad V8 engine runs completely opposite to the granola-bar-eating ethos of the mobility industry. However, gearheads love it, and that has scored much street cred for GM stock.

On the other end, General Motors understands the importance of staying atop rising trends. That’s why the company invested in a new modular platform for its EVs. As well, it developed a new battery system called Ultium, which may give the automaker an edge in the crowded EV market.

Best of all, General Motors has several car brands that resonate with consumers across generations. Therefore, management could potentially leverage this familiarity factor by electrifying the brands people love, thus meeting the modern consumer where they are.

In the meantime, GM stock can steadily rise on the extended relevancy that the government ruling provided. According to the Department of Energy’s website, two-thirds of U.S. housing units had a garage or carport. So, a majority of drivers could theoretically charge at home (assuming they purchase the system necessary to do so).

However, it also means that many drivers cannot charge at home. By logical deduction, they would be limited to public charging options. With the poor demand in the EV space right now, there’s less incentive for EV infrastructure providers to stick their heads out. That’s an issue to watch closely.

Rising Value Yet Still Cheap

Despite the strong performance of GM stock in the charts this year, it’s still a discounted opportunity. At the moment, shares trade at a forward earnings multiple of 4.8x. That seems awfully cheap, considering the expected trajectory of General Motors.

For Fiscal Year 2024, analysts estimate, on average, that earnings per share (EPS) will land at $8.27. In addition, revenue may reach $161.79 billion. In contrast, the company posted EPS of $7.07 on sales of $158.19 billion last year.

Further, for Fiscal 2025, analysts believe the company will post EPS of $8.37 on sales of $164.08 billion. It’s not stratospheric growth, but the combo of a government lifeline and favorable economic conditions (that is, conditions that are worse for EVs) makes GM stock very intriguing.

Who knows? The metrics may land near analysts’ most optimistic targets rather than the average.

Is GM Stock a Buy, According to Analysts?

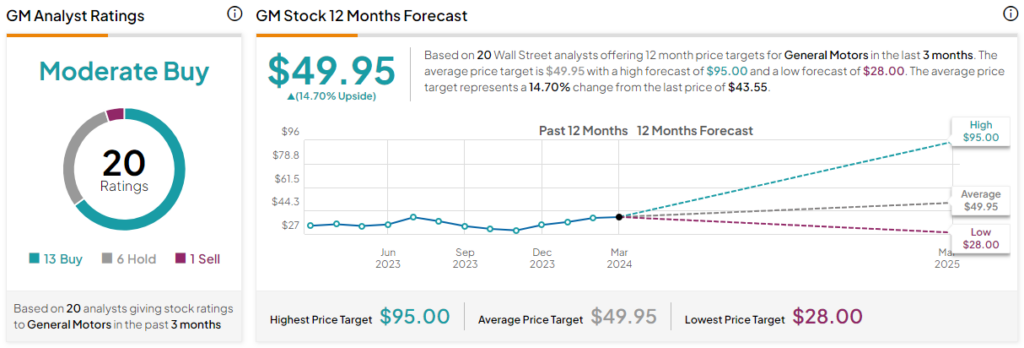

Turning to Wall Street, GM stock has a Moderate Buy consensus rating based on 13 Buys, six Holds, and one Sell rating. The average General Motors stock price target is $49.95, implying 14.7% upside potential.

The Takeaway: A Government Lifeline Makes GM Stock Surprisingly Compelling

In summary, the recent government decision to soften fuel economy rules has provided a significant boon to legacy automaker General Motors, offering the company an extended lifeline and fundamental relevance in the market.

While maintaining efficiency standards, GM now has the flexibility to continue producing combustion-powered vehicles through 2030, alleviating potential fines and positioning the stock favorably amid the evolving automotive landscape. It also denies an advantage to pure-play EV competitors, making GM stock an intriguing opportunity.