The U.S. Securities and Exchange Commission (SEC) is set to approve the first exchange traded fund (ETF) based on Ether (ETH-USD) Futures, marking a win for several issuers who have filed applications to offer the product, Bloomberg reported. Ether is the native token of the Ethereum network.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

SEC Set to Approve Ether Futures ETF

The SEC has, until now, refused to allow an ETF based directly on Bitcoin (BTC-USD), Ether, or any other cryptocurrency. However, in late 2021, the regulatory agency approved an ETF based on Bitcoin Futures contracts that trade on the Chicago Mercantile Exchange (CME).

Speculations are high that the SEC will now allow a product involving derivatives in the second-largest cryptocurrency. Sources told Bloomberg that officials have indicated that several firms might win approval for the product by October.

Nearly 12 companies have filed applications to launch an ETF based on Ether Futures. Reportedly, six firms (Volatility Shares, Bitwise, VanEck, Roundhill, ProShares, and Grayscale) have filed applications for Ether Futures ETFs following the recent hype surrounding Spot Bitcoin ETFs. The buzz around Spot Bitcoin ETFs was mainly triggered when BlackRock (NYSE:BLK) filed an application in June.

The SEC has been reluctant to launch ETFs based on cryptocurrencies due to concerns about price manipulation and liquidity.

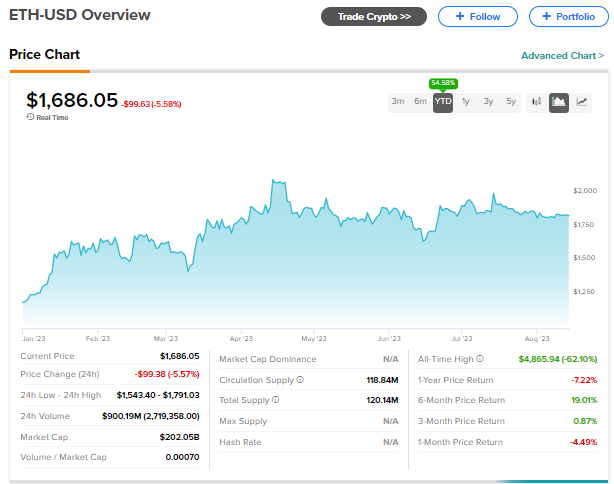

On Thursday, Ether rallied in reaction to the news of an ETF based on Futures. However, on Friday, Ether, Bitcoin, and several other cryptocurrencies were trending lower over worries about elevated interest rates. Also, there were some reports that Bitcoin was impacted by a Wall Street Journal article about Elon Musk’s space exploration venture SpaceX offloading its holdings in the largest cryptocurrency.